NRG Energy signs $5.2bn deal to take Vivint Smart Home private

NRG Energy has agreed to acquire US-based publicly-listed Vivint Smart Home for a consideration of $5.2 billion or $12 per share, which includes around $2.8 billion in cash and the assumption of $2.4 billion debt.

The combined entity with a network of around 7.4 million customers across North America, is expected to become one of the leading essential home solutions platforms.

The transaction is expected to help NRG Energy accelerate its growth plan, diversify the company’s financial profile and increase its total market opportunity.

NRG Energy is said to gain market-leading brands, proprietary technologies, unparalleled insights, and complementary sales channels as part of the acquisition.

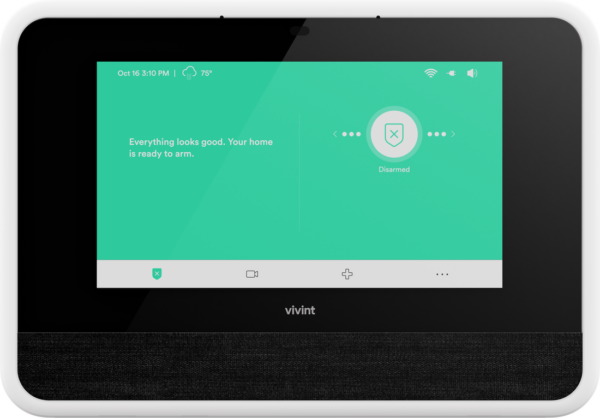

Vivint Smart Home offers technology, services, and products to create a smarter, safer, and more efficient home.

The smart home platform company delivers artificial intelligence and machine learning-enabled operating systems for smart home experience.

Vivint Smart Home provides hardware, software, sales, installation, support, and professional monitoring services. In early 2020, Vivint Smart Home went public through a merger with Mosaic Acquisition Corp.

Mauricio Gutierrez — NRG Energy President and CEO said: “The acquisition of Vivint is a transformational step in achieving our vision.

“Customers want simple, connected, and customized experiences that provide peace of mind.

“Vivint’s smart home technology strengthens our retail platform, improves our customer experience, and increases customer lifetime value.”

Post-closing, NRG anticipates maintaining a significant footprint in Utah.

David Bywater — Vivint Smart Home CEO said: “We are pleased to announce a transaction that delivers immediate and compelling cash value to Vivint’s stockholders while also presenting significant opportunities to drive our company’s continued success in the years to come.”

Goldman Sachs & Co and J.P. Morgan Securities are acting as exclusive financial advisors to NRG Energy and Vivint Smart Home, respectively.

White & Case is serving as legal counsel to NRG Energy while Simpson Thacher & Bartlett is acting as legal counsel to Vivint Smart Home.

The transaction is expected to close in the first quarter of 2023, is subject to customary closing conditions.