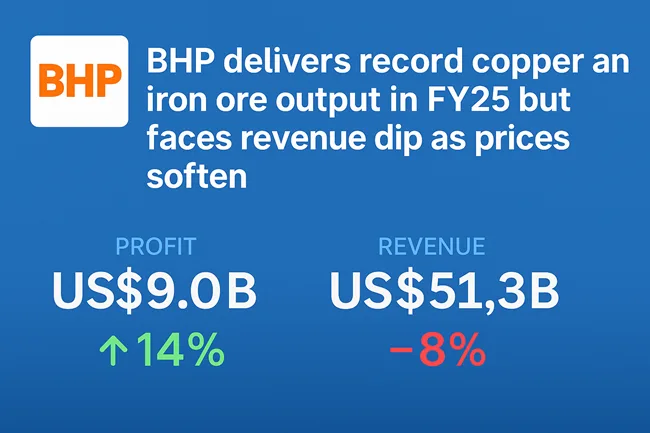

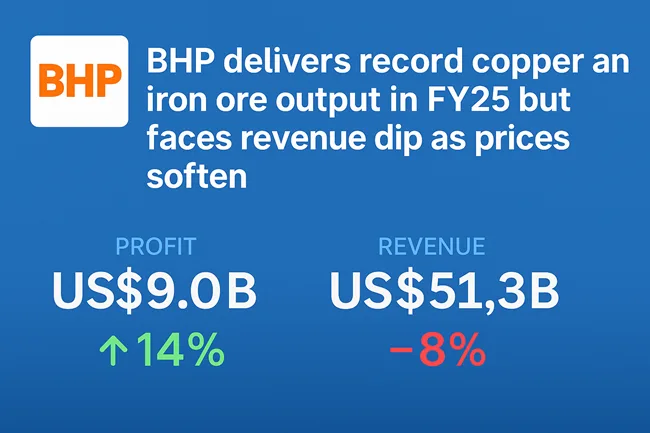

BHP Group Limited (ASX: BHP, LSE: BHP, NYSE: BHP) has capped FY25 with record output in copper and iron ore, a testament to its cost leadership and operational scale, but weaker iron ore and coal prices clipped overall revenue. The Anglo-Australian miner posted attributable profit of US$9.0 billion, up 14% from last year, even as revenue fell 8% to US$51.3 billion. Underlying EBITDA slipped 10% to US$26.0 billion, though margins held firm at 53%, underscoring how productivity and efficiency gains shielded earnings from commodity volatility.

The final dividend was set at US$0.60 per share, taking total FY25 shareholder returns to US$5.6 billion. While BHP continued to pour capital into copper and potash growth projects, management stressed that discipline and sequencing would prevent overstretching in a period of shifting prices and rising inflationary pressures.

How did BHP’s operational performance in FY25 offset weaker commodity prices across iron ore and coal?

Operational strength was the defining theme of FY25. Copper production surged to 2,017 kilotonnes, an 8% year-on-year rise and 28% above FY22, marking three consecutive years of growth. Escondida, BHP’s flagship Chilean mine, produced its highest volumes in 17 years, while Copper South Australia delivered a half-year record after overcoming a weather-related outage.

Iron ore production reached 263 million tonnes, a modest 1% increase, but the supply chain efficiency of Western Australia Iron Ore (WAIO) allowed shipments of 290 million tonnes on a 100% basis. South Flank exceeded nameplate capacity, cementing WAIO’s status as the world’s lowest-cost producer, with unit costs of US$17 per tonne.

This operational momentum helped cushion the impact of softer commodity prices. Benchmark iron ore prices averaged US$100 per dry metric tonne, down from FY24’s US$120/dmt. Steelmaking coal prices also weakened amid oversupply, trimming segment earnings. By contrast, copper prices averaged US$4.25/lb, up from US$3.98/lb, as resilient Chinese demand and tighter supply drove gains.

Institutional sentiment was clear: investors praised BHP’s ability to defend margins through cost reductions and productivity gains, even as prices for its most lucrative commodities declined.

What role did copper play in driving BHP’s earnings growth and long-term energy transition strategy?

Copper has become the cornerstone of BHP’s earnings profile. In FY25, it accounted for 45% of group underlying EBITDA, up from 29% in FY24. Segment EBITDA jumped 44% to US$12.3 billion, with margins climbing to 59%.

Escondida contributed US$8.6 billion, supported by higher grades and cost improvements, while Copper South Australia delivered US$1.9 billion despite inventory drawdowns. Spence also set production records, with unit costs falling 3%.

Strategically, copper’s importance goes beyond near-term profits. BHP forecasts that global copper demand will grow from 33 million tonnes today to more than 50 million tonnes by 2050, driven by electrification, renewable grids, and digital infrastructure. To meet this demand, the world will need roughly 10 million tonnes of new mine supply over the next decade.

BHP is positioning itself to deliver this supply. Projects at Escondida, Carrapateena, and Prominent Hill are being optimized, while the Vicuña joint venture in Argentina and Chile — which includes the giant Filo del Sol discovery — is advancing as one of the most important copper growth stories of the decade. The miner also holds a 45% stake in the Resolution Copper Project in the United States, a potential top-tier North American asset.

Analysts say copper has transformed from a supporting revenue stream into BHP’s most strategic growth driver, insulating the company from the cyclical swings of iron ore and coal.

How is BHP balancing shareholder returns with capital spending on potash, copper, and iron ore growth projects?

BHP lifted capital and exploration expenditure to US$9.8 billion, up from US$9.3 billion in FY24. Roughly 70% of this spend was directed toward copper and potash, reflecting management’s tilt toward “future-facing” commodities.

The Jansen potash project in Canada remains central to this shift. Stage 1 is on track for first production in mid-2027, though its cost estimate has been revised upward to US$7.0–7.4 billion from US$5.7 billion, due to inflation and scope changes. Stage 2 has been delayed by two years to smooth capital deployment.

In South Australia, the growth pipeline includes the Prominent Hill Expansion (PHOX), Carrapateena Block Cave, and Olympic Dam’s Southern Mining Area Decline. BHP is also studying a Smelter and Refinery Expansion (SRE) that would transition Olympic Dam to a two-stage smelter, potentially unlocking synergies from the OZ Minerals acquisition.

Iron ore remains BHP’s cash engine. The miner has approved a sixth car dumper project at WAIO, with capex of around US$0.9 billion and an internal rate of return above 30%, due for completion by FY28. These investments will sustain production levels above 305 million tonnes per year.

Despite higher spending, BHP has stuck to its capital return framework. The final dividend reflected a 60% payout ratio, consistent with its promise to balance growth with shareholder distributions. Since January 2020, the miner has returned US$59 billion in cash to investors.

What progress did BHP make on sustainability, social value, and workforce diversity in FY25 results?

BHP made notable strides in its sustainability and social value agenda. Operational greenhouse gas emissions fell 36% compared with FY20 levels, putting the company on track to achieve its 30% reduction target by 2030. Emission reductions were supported by renewable power purchase agreements and the temporary suspension of its Western Australia Nickel operations.

The company also boosted Indigenous procurement spend in Australia to US$853 million, up 40% year-on-year, while launching a 158,000-hectare conservation project in South Australia. Total economic contribution across suppliers, contractors, employees, governments, and communities reached US$46.8 billion, with shareholder payments representing 13% of the total.

BHP also achieved a milestone in workforce diversity. Women now make up 41.3% of its global employee base, making BHP the first global listed mining company to reach gender balance. Female leadership representation rose to 36.5%, reflecting a sustained focus on inclusion and cultural change.

These achievements reinforced BHP’s ESG standing, a key driver of institutional flows given the increasing weight of sustainability in global investment strategies.

How do analysts and institutional investors view BHP’s long-term outlook amid commodity volatility?

On 19 August 2025, BHP’s stock closed at A$42.11 on the Australian Securities Exchange, giving it a market capitalization of A$213.75 billion. The stock offered a dividend yield of 4.51%, a price-to-earnings ratio of 12.20, and a one-year return of 5.99%.

Investor sentiment has been shaped by two realities: iron ore and coal remain cyclical, but copper and potash provide structural growth exposure. Institutional investors view BHP as a long-term “hold,” with steady accumulation around current price levels.

While some concerns remain over cost inflation at Jansen and potential capital overruns in South Australia, analysts highlight BHP’s ability to maintain EBITDA margins above 50% for two decades as evidence of structural resilience. The company’s balance sheet, with net debt rising to US$12.9 billion, is seen as manageable given strong cash flow generation.

Can BHP sustain its copper-led growth momentum into FY26 while managing cost inflation and debt levels?

For FY26, BHP has guided copper production of 1.8–2.0 million tonnes and iron ore output of 258–269 million tonnes. Steelmaking coal demand is expected to stabilize as new blast furnace capacity comes online in Asia, while potash markets remain supported by global agricultural demand.

Longer-term, copper and potash are set to drive portfolio transformation. Copper South Australia and Escondida optimizations, coupled with Jansen’s ramp-up, could see BHP double attributable copper production by the 2030s. Iron ore will continue to underpin cash generation, ensuring resilience across cycles.

The challenge lies in balancing capital discipline with execution risks. Inflationary pressures, regulatory complexity, and geopolitical trade tensions remain headwinds. Yet, with a diversified portfolio, sector-leading costs, and a proven capital allocation framework, BHP is positioned to deliver shareholder value through both cycles and transitions.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.