The race to build high-performance AI hardware is no longer just about transistor density or chip efficiency. As devices grow smaller and workloads become increasingly complex, engineers are realizing that chip design can no longer be isolated from the physical environments where these systems operate. This has given rise to what many in the industry are calling the silicon-to-systems workflow—a design paradigm that integrates semiconductor logic, printed circuit board (PCB) layouts, and multiphysics simulation into a unified process.

The urgency behind this shift was underscored when Synopsys, Inc. (NASDAQ: SNPS) cleared final regulatory approvals in July 2025 for its $35 billion acquisition of Ansys, Inc. (NASDAQ: ANSS). Synopsys, long regarded as a cornerstone of semiconductor electronic design automation (EDA), is now making a bold attempt to move beyond the chip layer into the world of thermal modeling, structural mechanics, and real-world physics simulation—domains historically dominated by Siemens Digital Industries and Dassault Systèmes.

This integration is not just a market expansion strategy; it reflects how AI, edge computing, and autonomous systems are reshaping engineering workflows. As real-world physics—heat dissipation, electromagnetic interference, vibration tolerances—become bottlenecks for performance, designing AI systems in silos is no longer sustainable.

How does Synopsys’ silicon-first approach differ from Siemens’ and Dassault’s mechanical-first strategies?

For decades, Siemens Digital Industries and Dassault Systèmes have held near-monopolistic control over mechanical and multiphysics simulation for industries like aerospace, automotive, and industrial robotics. Siemens’ Simcenter and Dassault’s SIMULIA platforms allowed engineers to model complex behaviors such as fluid flow in jet engines or stress analysis in vehicle chassis. These tools, however, evolved with a mechanical-first mindset—chips and electronics were treated largely as black boxes within larger systems.

Synopsys, by contrast, built its expertise from the ground up in semiconductor logic. Its flagship EDA tools—such as Design Compiler and PrimeTime—are integral to the development of advanced chips used by NVIDIA, AMD, and Intel. But until now, Synopsys largely ignored what happens once those chips are placed in a server rack, an electric vehicle, or an aerospace-grade enclosure.

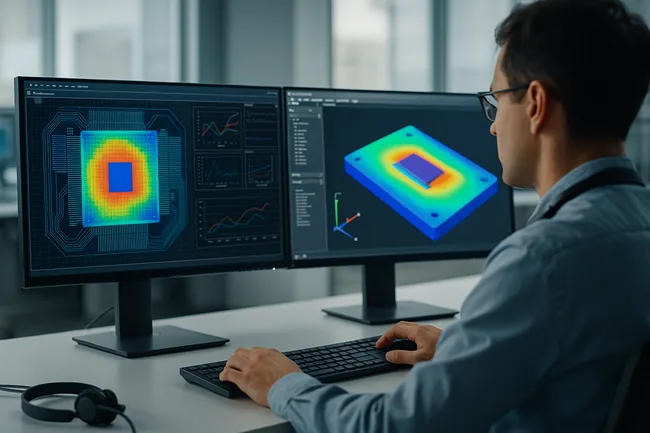

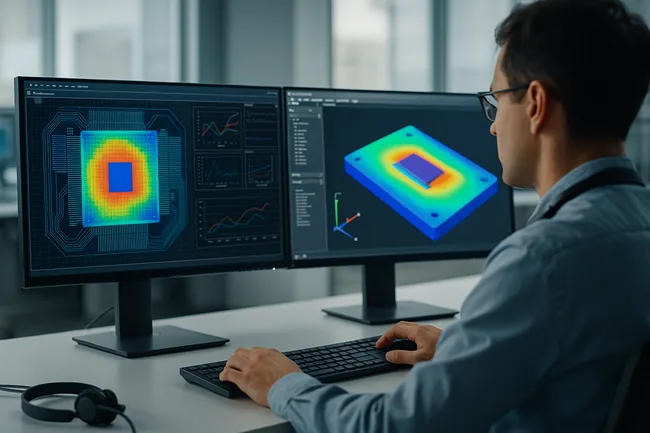

By acquiring Ansys, a company that excels in computational fluid dynamics, electromagnetic simulation, and thermal modeling, Synopsys is flipping the workflow on its head. Instead of treating electronics as passive components in larger mechanical systems, Synopsys envisions a unified co-design environment where chip behavior directly informs mechanical design decisions—and vice versa.

Institutional analysts suggest this could be a major differentiator in markets like autonomous vehicles and data center infrastructure, where cooling and power efficiency are as critical as computational throughput. With Synopsys now owning both EDA and multiphysics simulation tools, customers can theoretically optimize every layer of a system simultaneously, something Siemens and Dassault cannot yet fully replicate.

What competitive challenges could Synopsys face against entrenched players like Siemens and Dassault?

While the Synopsys–Ansys combination promises a unique silicon-to-systems edge, the American software developer faces significant hurdles. Siemens and Dassault have decades of entrenched relationships with aerospace and automotive manufacturers, who have invested heavily in their existing mechanical simulation ecosystems. Migrating entire engineering workflows to a new, unified platform will require clear evidence of performance and cost benefits.

Moreover, Dassault has been steadily expanding its electronics simulation capabilities through incremental acquisitions, and Siemens’ 2017 acquisition of Mentor Graphics gave it a foothold in PCB and chip-package co-design. Both European firms have been positioning themselves as end-to-end digital twin providers, which could blunt Synopsys’ narrative of being the only player offering complete integration.

Another challenge lies in execution. Integrating Ansys’ broad product suite into Synopsys’ highly specialized EDA environment will be a complex process. Analysts point out that customers value stability and seamless interoperability, and any post-merger friction could slow adoption. Synopsys will also need to convince traditionally conservative sectors, such as aerospace and energy, that a chip-centric platform can outperform established mechanical-first solutions.

Why does the silicon-to-systems approach matter for the future of AI, edge computing, and autonomous systems?

The push toward silicon-to-systems convergence is being driven by the physics limits of AI hardware. For instance, training large language models demands graphics processing units (GPUs) and application-specific integrated circuits (ASICs) that operate at the edge of thermal and power envelopes. Engineers must now design systems where the chip package, cooling systems, and enclosure materials work in harmony to maximize performance without overheating or signal interference.

In electric vehicles, similar challenges exist—optimizing battery thermal management and power electronics requires co-simulating chips and mechanical components in a single workflow. Aerospace avionics and industrial robotics face parallel constraints, where vibration resistance and electromagnetic compatibility can make or break system reliability.

Synopsys’ bet is that its unified platform will become the default toolset for these next-generation applications, allowing engineering teams to shorten development cycles and improve first-pass success rates. Institutional investors view this as a multi-year growth opportunity, particularly as the company expands its total addressable market from $18 billion to $28 billion post-acquisition, with an estimated 11% compound annual growth rate.

What could the next phase of competition look like in the engineering software market?

The battle between Synopsys, Siemens, and Dassault is expected to intensify as each company works to protect its traditional strongholds while aggressively moving into adjacent domains. For Synopsys, the immediate priority will be bundling Ansys’ multiphysics simulation tools with its own EDA software to deliver quantifiable improvements in power efficiency, thermal performance, and system reliability. Early adopter markets such as electric vehicles, aerospace avionics, and hyperscale data centers are expected to be the proving grounds where Synopsys can demonstrate the value of a unified silicon-to-systems workflow.

Siemens and Dassault are unlikely to concede ground easily. Both European industrial software leaders are expected to accelerate acquisitions or form strategic partnerships to close the semiconductor and PCB co-design gap in their digital twin platforms. Their long-standing customer relationships with major automotive and aerospace manufacturers give them a defensive advantage, but expanding into chip-aware simulation will require significant investment in both software development and talent acquisition. Startups specializing in AI-driven simulation, generative design, and chip-package thermal modeling could become prime acquisition targets, further fueling a wave of consolidation in the engineering software industry.

Competitive dynamics may also shift toward ecosystem partnerships rather than outright software replacement. Analysts believe that Siemens and Dassault could focus on integrating with existing chip design workflows through open APIs, reducing the friction for customers who are reluctant to abandon their entrenched simulation platforms. However, if Synopsys can deliver seamless integration that shortens development cycles and cuts prototyping costs, it could pressure these incumbents to either co-opt its platform or risk being marginalized in the fast-growing AI hardware and electrification segments.

If Synopsys executes its integration strategy effectively, it may not only reshape how AI hardware is designed but also redefine the hierarchy of the engineering software market itself. The next two to three years will be critical in determining whether silicon-to-systems convergence becomes the default standard across industries—or remains an ambitious experiment that primarily benefits niche, high-performance markets.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.