US bank holding firms Columbia Banking System, Umpqua complete merger deal

Columbia Banking System, the parent company of Columbia Bank, and Umpqua Holdings Corporation, the holding company for Umpqua Bank, have closed their previously announced merger.

The all-stock deal, which was announced by the American bank holding companies in October 2021, is aimed at creating one of the largest banks based on the US West Coast with more than $50 billion in assets under management.

The combined bank holds nearly $37 billion in loans and deposits of $45 billion across eight states. Columbia Banking System will be the surviving bank holding company, which will continue to be headquartered in Tacoma, Washington.

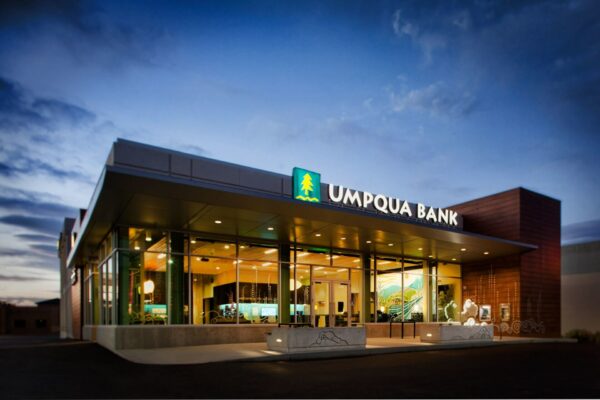

All branches of the combined entity will work under the Umpqua Bank banner after the completion of the integration. The combined bank holding company will trade under Columbia Banking System’s ticker symbol — COLB on Nasdaq.

The enlarged bank is now listed among the top 30 US banks.

US bank holding firms Columbia Banking System, Umpqua complete merger deal. Photo courtesy of PRNewswire/Columbia Banking System, Inc.

Recently, the combined bank announced an $8.1 billion commitment over five years to increase accessibility to affordable homeownership, formation and growth of small businesses, as well as initiatives to promote community development and philanthropy.

Clint Stein — CEO of Columbia Banking System and Umpqua Bank said: “Bringing together the Northwest’s leading banks is a historic achievement and holds enormous potential to benefit our associates, customers, and communities, as well as to drive our company’s long-term growth. I’m especially proud of our associates whose hard work, perseverance, and truly collaborative spirit made this combination of like-minded banks possible.

“As we look to the future and the full integration of our new company, we remain laser focused on leveraging our scale advantages to provide a premium banking experience for our customers.”

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.