Why the $40bn Aligned Data Centers megadeal has reignited interest in AI infrastructure stocks

The USD 40 billion acquisition of Aligned Data Centers by the Artificial Intelligence Infrastructure Partnership (AIP), MGX, and BlackRock’s Global Infrastructure Partners has done more than reshape the private data center landscape—it has forced investors to reprice the value of compute itself. With this transaction setting a new valuation benchmark, public market investors are now scanning for liquid proxies that offer exposure to the same theme: scalable, energy-optimized, AI-ready infrastructure.

The logic is simple. If private capital is willing to pay $40 billion for a platform like Aligned, listed data center REITs, AI-linked utilities, and hardware-integrated infrastructure players may still be trading below intrinsic value. Institutional allocators are shifting from speculative AI applications to the physical layer—the power, land, and silicon that make artificial intelligence operational at scale.

Which listed companies are positioned to gain most from the AI data center build-out wave?

Equinix (NASDAQ: EQIX) has emerged as the closest public-market equivalent of Aligned’s infrastructure profile. With over 270 data centers across 76 markets, Equinix sits at the intersection of connectivity, power, and interconnection density. Its ongoing investments in liquid cooling and renewable power sourcing align directly with the AI hardware wave dominated by GPUs and high-density compute racks. Although the company’s 2025 earnings guidance revision triggered a brief correction, institutional sentiment remains constructive given its irreplaceable footprint and growing capital partnerships.

Digital Realty Trust (NYSE: DLR) is seen as the other core REIT exposure for the AI infrastructure theme. The company has expanded its Americas pipeline to nearly 500 megawatts and continues to push toward higher-density builds for AI workloads. Its ongoing partnerships with GPU cloud providers and its focus on hybrid-cloud integration make it one of the most direct beneficiaries of enterprise AI adoption. Digital Realty is increasingly viewed by institutional investors as the more scalable, volume-driven counterpart to Equinix’s premium model.

NVIDIA (NASDAQ: NVDA), while primarily a semiconductor leader, also benefits from infrastructure exposure through its foundational partnership in the AIP consortium. As data center demand grows, NVIDIA’s strategy extends beyond chip sales into ecosystem-level participation—from compute fabric orchestration to modular AI clusters. Its involvement in AIP reflects a recognition that future hardware sales depend on access to sustainable, scalable data infrastructure.

NextEra Energy (NYSE: NEE), the world’s largest renewable energy company by market capitalization, represents the power side of the AI infrastructure equation. With AI workloads projected to strain grid capacity by the decade’s end, utilities like NextEra—equipped with large renewable portfolios and storage capabilities—are becoming key enablers of AI data centers. For investors, this positions NextEra as an “energy infrastructure proxy” for the AI boom, capturing upside from both decarbonization and digitalization.

Secondary beneficiaries include DigitalBridge Group and Brookfield Infrastructure Partners, both of which have diversified digital asset portfolios spanning towers, fiber, and data centers. These firms are actively raising sovereign-backed funds targeting AI infrastructure in North America, Europe, and Asia, aiming to mirror AIP’s multi-trillion-dollar pipeline ambition.

How are data center REITs and energy firms evolving into next-generation AI infrastructure leaders?

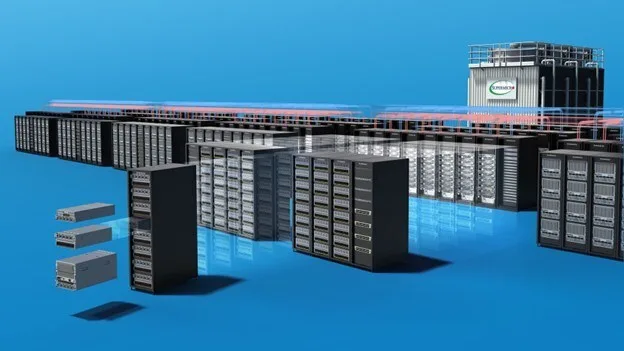

Traditional data center REITs once operated like landlords—leasing power and space. Today, they function more like digital utilities. Equinix and Digital Realty are embedding AI-specific features into their infrastructure, including higher rack densities, on-site energy generation, and advanced cooling systems. They are also securing multi-year renewable power purchase agreements to ensure stable energy supply for AI workloads.

This evolution has blurred the boundaries between real estate, energy, and technology. Utilities like NextEra and Duke Energy are now active participants in AI ecosystem planning, offering tailored grid connections for hyperscale clients. The next phase of this transition will likely see tighter integration—joint ventures between REITs and utilities to co-develop AI campuses capable of 100+ MW per site.

In this hybrid model, data center operators manage the digital layer while utilities anchor the physical grid. The companies that succeed will be those capable of orchestrating both worlds—balancing uptime, efficiency, and carbon footprint in one operational stack.

What does market sentiment reveal about valuations, flows, and the next AI infrastructure cycle?

Market performance across the AI infrastructure basket has mirrored enthusiasm for the broader compute economy. Equinix and Digital Realty stocks have outperformed the S&P 500 year-to-date, supported by institutional inflows from infrastructure-focused ETFs. Equinix trades at a forward price-to-FFO multiple near 25x—expensive by traditional REIT standards but justified by its strategic positioning as a mission-critical AI enabler.

Digital Realty offers a slightly higher dividend yield, appealing to long-term investors seeking both growth and stability. Analysts describe both REITs as “bond-like growth stories” where AI demand acts as a structural hedge against rate volatility. Institutional investors have also launched dedicated funds tracking “digital infrastructure yield,” capturing exposure to data centers, fiber optics, and grid modernization projects.

Energy-aligned names are entering the narrative too. NextEra’s focus on renewable integration and grid balancing has drawn attention from sustainability-linked funds that now view AI energy intensity as an ESG challenge. For them, owning power producers linked to AI infrastructure is both a green and growth-aligned bet.

Across hedge funds and pensions, sentiment toward the sector remains decisively bullish. The Aligned deal established a valuation floor for private players, which in turn re-rated public REITs upward by association. The market is effectively pricing in a multi-decade build cycle—similar in magnitude to past energy or telecom infrastructure booms.

How do public AI infrastructure stocks compare to private platforms like Aligned in risk and opportunity?

Publicly traded infrastructure firms offer transparency, liquidity, and dividend yields, but they face structural constraints. Regulatory oversight, slower permitting, and shareholder scrutiny limit how aggressively they can pursue capital-intensive expansions. Private platforms like Aligned can move faster, negotiate custom energy contracts, and leverage sovereign relationships without quarterly market pressure.

However, public players benefit from continuous valuation discovery and capital market access. Institutional funds can scale exposure instantly through equities or ETFs, while private deals demand years of lockup and higher minimum investment. As the compute economy grows, public markets will likely become the dominant vehicle for infrastructure participation, particularly for retail and pension capital.

In effect, the public and private markets are converging toward the same goal—building and owning the digital backbone of the AI era. The difference lies in execution speed and yield distribution.

What should investors watch next in the race to own the infrastructure powering AI?

For investors, the immediate focus should remain on companies demonstrating consistent capacity expansion, energy strategy clarity, and tenant diversification. Equinix’s rapid global growth, Digital Realty’s expanding pre-lease pipeline, and NextEra’s renewable scaling will remain key indicators of sustainable leadership.

The new metrics driving valuation in this sector go beyond traditional REIT measures. Analysts now emphasize compute yield—the amount of compute delivered per dollar of asset value—and energy elasticity, the ability to scale power usage efficiently. Firms that can enhance these metrics will command valuation premiums as the AI infrastructure boom matures.

Equinix and Digital Realty represent the most direct public gateways into the AI infrastructure buildout, while NextEra Energy provides a strategic hedge through the power and ESG lens. NVIDIA remains the hardware cornerstone, and Brookfield Infrastructure adds a sovereign-aligned diversification layer.

The broader takeaway is unmistakable: the race for AI supremacy will be won not just by software innovators but by those who own the real estate, energy, and silicon that make intelligence possible. The Aligned deal has confirmed that compute is the new energy—and for investors, the infrastructure powering it is where the next trillion-dollar opportunity lies.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.