Precision Cell Systems (PCS) has formally launched following the acquisitions of S2 Genomics and ORFLO, combining their complementary technologies to streamline critical bottlenecks in cell analysis workflows. The privately held life sciences tools company enters the market with over 1,000 installed instruments, a base of more than 700 customers, and a portfolio supported by over 500 peer-reviewed publications and 25 patents, marking a rapid emergence as a consolidated force in the cell analysis sector.

How is Precision Cell Systems using consolidation to reshape the fragmented cell analysis tools market?

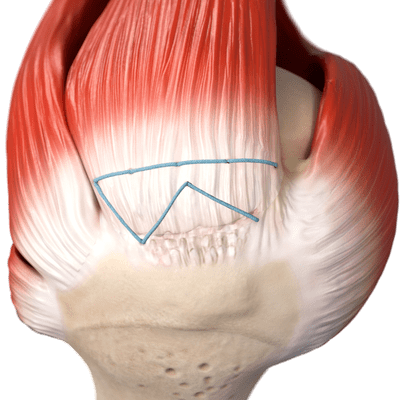

The launch of Precision Cell Systems underscores a strategic consolidation move at a time when many mid-sized life science tools firms are struggling to scale profitably. By absorbing S2 Genomics and ORFLO, PCS has positioned itself to address two entrenched pain points in cell analysis: the time-consuming manual process of tissue dissociation and the complexity of accurate cell counting. The company’s Singulator platform automates tissue dissociation to generate highly reproducible nuclei and single-cell suspensions, while the Moxi line integrates disposable cassette-based technology for rapid, flow cytometry-grade cell counts.

Industry observers have noted that merging these complementary platforms into one unified workflow can help labs accelerate time-to-result, improve reproducibility, and reduce operational burden. PCS executives reported that within months of the acquisitions, they had cut combined operating expenses by over 35% while still delivering revenue growth. This efficiency-driven model reflects a broader trend in the life sciences sector, where investors are pushing for operational discipline and consolidation after years of venture-backed expansion that often left promising tools companies capital constrained.

Why are investors backing Precision Cell Systems’ consolidation-driven growth strategy?

BroadOak Capital Partners, which has invested in over 50 life sciences companies, has emerged as a key backer of PCS, signaling confidence in its capital-efficient roll-up approach. Analysts following BroadOak’s portfolio strategies suggested that its investment signals growing institutional support for consolidation plays that can rationalize fragmented niches in the research tools market. In this case, PCS is betting that combining operational infrastructure, sales channels, and technical platforms under one roof can create a defensible and profitable cell analysis powerhouse.

The sentiment around PCS’s launch is cautiously optimistic in the broader investor community. Many venture firms have pulled back from life sciences tools startups in recent quarters, pressuring companies to prove capital efficiency earlier. PCS’s ability to reduce costs and simultaneously grow revenues has been interpreted by analysts as a promising proof-of-concept for its model. While the company is privately held and not publicly traded, its emergence has drawn attention from institutional investors who have been rotating capital into profitable or near-profitable tools companies as part of a defensive sector shift.

What makes the Singulator and Moxi platforms vital for accelerating cell analysis workflows?

The Singulator platform, acquired through S2 Genomics, stands out for automating the dissociation of tissue samples into single cells or nuclei, replacing a traditionally labor-intensive manual process that has long been prone to variability. Researchers at institutions such as Memorial Sloan Kettering Cancer Center have highlighted its consistency, describing it as a walk-up service in core labs that has become indispensable for generating reproducible nuclei extractions. This level of reproducibility has been validated across more than 30 peer-reviewed publications spanning cancer research, immunotherapy development, and drug discovery workflows.

The Moxi products, originally developed by ORFLO, offer another disruptive edge: flow cytometry-quality cell counting via an easy-to-use disposable cassette format. This eliminates the maintenance burden of traditional flow cytometers while delivering comparable analytical accuracy, which can be critical for time-sensitive studies. Integrating Singulator’s automated tissue dissociation with Moxi’s rapid cell quantification creates an end-to-end solution for labs, enabling them to move from tissue sample to accurate cell data in a fraction of the time and with less labor-intensive oversight.

How could Precision Cell Systems’ leadership experience influence its commercial execution?

PCS is led by CEO Anup Parikh, who previously held leadership roles at Mission Bio and 10x Genomics, companies renowned for their innovation and rapid growth in single-cell genomics and molecular analysis. He is joined by Chief Commercial Officer Terry Salyer, who has driven revenue growth at Unchained Labs and ProteinSimple, and Chief Operating Officer Bruce Leisz, who brings operational expertise from Pacific Biosciences and Affymetrix. Collectively, this leadership team blends experience in scaling life sciences tools companies, building commercial infrastructure, and executing post-merger integrations—skills that are crucial to PCS’s acquisition-led growth strategy.

Market analysts have pointed out that this combination of technical and commercial leadership could help PCS navigate the operational complexity that often derails consolidation efforts. While many small tools companies have strong technologies, they often lack the sales infrastructure or operational scale to sustain growth. PCS’s executive team appears to be aiming to bridge that gap by using its early scale efficiencies to reinvest in sales channels, customer support, and R&D pipelines.

What are the potential implications of PCS’s strategy for the broader life sciences tools sector?

PCS’s approach reflects a growing recognition that the life sciences tools market is oversaturated with niche players that individually struggle to achieve profitability, despite offering critical technologies. This has created an environment where consolidation is increasingly viewed as not just opportunistic but inevitable. If PCS successfully integrates its acquisitions and drives sustained profitability, it could set a template for other investors seeking to build full-stack research platforms through roll-ups.

The company has already indicated plans to pursue additional acquisitions targeting complementary technologies in sample preparation, functional cellular and molecular assays, and advanced data analysis solutions. Such moves could enable PCS to evolve from an instrument provider into a comprehensive cell analysis ecosystem. This trajectory mirrors earlier consolidation waves seen in genomics and proteomics, where a handful of integrated platform players emerged as dominant market leaders by stitching together best-in-class point solutions.

Could Precision Cell Systems emerge as a future public listing candidate in the research tools space?

Although PCS is currently private, its rapid scale, strong early traction, and backing from an institutional investor like BroadOak Capital Partners have fueled speculation about its long-term exit strategies. Industry experts have noted that research tools companies with defensible technology portfolios, recurring consumables revenue, and double-digit EBITDA margins often become attractive IPO candidates or acquisition targets for larger life sciences conglomerates. If PCS continues to expand its installed base and achieve margin growth, it could follow a similar trajectory to companies like 10x Genomics (NASDAQ: TXG) or Pacific Biosciences (NASDAQ: PACB), which successfully transitioned from niche innovators to publicly traded platforms.

For now, PCS is emphasizing organic growth and operational efficiency, signaling that it intends to build a sustainable business before considering capital market moves. Still, analysts tracking the sector believe that continued consolidation could make PCS a strategic acquisition target for larger players seeking to shore up their single-cell and cellular analysis capabilities, particularly as competitive dynamics shift toward integrated end-to-end workflows.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.