Electronic Arts Inc. (NASDAQ: EA) announced on September 29, 2025, that it has signed a definitive agreement to be acquired by a consortium consisting of the Public Investment Fund of Saudi Arabia (PIF), private equity powerhouse Silver Lake, and investment firm Affinity Partners. The all-cash transaction values the American video game publisher at approximately $55 billion, marking the largest sponsor-led take-private deal in history. Under the terms of the agreement, Electronic Arts stockholders will receive $210 per share, representing a 25 percent premium over the company’s unaffected closing price of $168.32 on September 25 and a significant premium over its all-time high of $179.01 reached in August 2025.

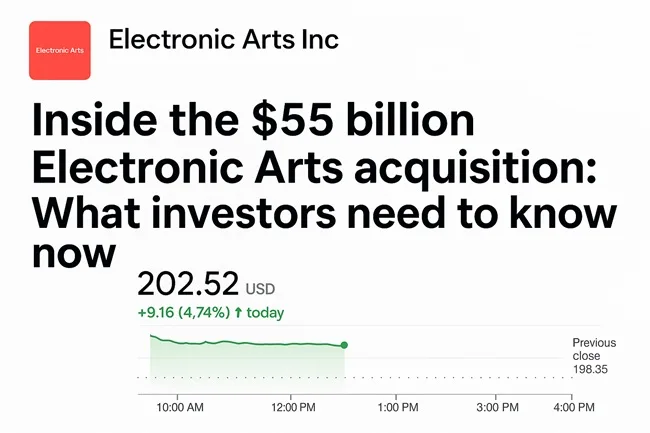

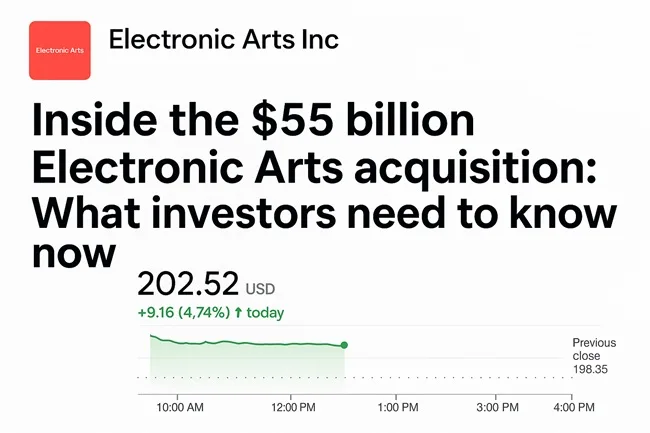

Shares of Electronic Arts reflected the momentum of the announcement, surging more than 4.7 percent in early trading to reach $202.52 by mid-day on September 29. Institutional sentiment shifted positively as investors interpreted the deal as a vote of confidence in Electronic Arts’ growth trajectory and intellectual property strength, while simultaneously offering a lucrative cash exit amid uncertain broader market conditions.

Why is the $55 billion take-private deal by PIF, Silver Lake, and Affinity Partners considered historic in global gaming?

The acquisition stands as a landmark moment for the gaming and entertainment sectors because of both its valuation and the nature of its backers. The Public Investment Fund, already deeply entrenched in esports, competitive tournaments, and studio funding, is using its Vision 2030 diversification strategy to cement Saudi Arabia as a global hub for digital and cultural content. Silver Lake, with extensive exposure to media, sports, and technology assets, brings both credibility and operational expertise. Affinity Partners, led by Jared Kushner, adds a layer of global political and investment connectivity.

This three-way combination signals not just a financial takeover but a reshaping of how global investors view interactive entertainment. Where once video game publishers were niche assets, they are now considered systemically important media companies whose intellectual property spans sports, storytelling, social platforms, and digital commerce. Analysts noted that this deal rivals or even surpasses Microsoft’s $69 billion acquisition of Activision Blizzard in its implications for competitive dynamics and industry consolidation.

How does the Electronic Arts acquisition compare to past valuations and financial performance benchmarks?

Electronic Arts has consistently been among the most valuable publicly traded video game publishers. Over the past decade, under the leadership of Andrew Wilson, the company doubled its annual revenue, nearly tripled EBITDA, and multiplied its market capitalization by five. The firm has benefited from a strategy emphasizing live service models, digital monetization, and the consistent strength of its licensed sports franchises such as FIFA, Madden NFL, and NHL, alongside original properties like Apex Legends and The Sims.

The acquisition price of $210 per share not only exceeds Electronic Arts’ recent highs but also signals investor appetite for premium valuations on strong intellectual property portfolios. Compared with other industry deals, the valuation sets a new high watermark, underscoring the degree of confidence placed by private equity and sovereign wealth investors in gaming as an evergreen growth category. Institutional investors pointed out that Electronic Arts’ recurring revenue streams from sports licensing and in-game transactions significantly de-risk the business, justifying the valuation premium.

What are institutional investors and market analysts saying about the Electronic Arts buyout?

Investor sentiment has largely tilted positive, with long-only funds praising the premium valuation and certainty of cash returns. For pension funds and passive index investors, the offer delivers immediate monetization at an attractive multiple. Hedge funds, meanwhile, are positioning around the deal spread, betting on timely closure given the strength of the financing commitments and the stature of the acquiring parties.

Analysts emphasized that although some investors might have preferred to see Electronic Arts remain a public company to capture future upside, the near-term certainty of $210 per share is compelling. They further noted that private ownership could provide management with freedom to experiment in areas such as artificial intelligence-driven game development, cloud gaming platforms, and integration of digital assets without the short-term earnings pressures of public markets.

What regulatory and financial steps must be cleared before the Electronic Arts acquisition closes?

The transaction has been unanimously approved by Electronic Arts’ Board of Directors, but it is subject to regulatory review and approval by shareholders. Antitrust authorities in both the United States and Europe are expected to scrutinize the deal, particularly because Electronic Arts holds exclusive sports gaming licenses and dominates multiple online multiplayer segments. While analysts do not expect the transaction to face the same level of regulatory hurdles that delayed Microsoft’s purchase of Activision Blizzard, heightened attention to gaming concentration remains a possibility.

From a financing perspective, the acquisition will be funded through a mix of $36 billion in equity contributions from the consortium and $20 billion in debt financing led by JPMorgan Chase. Approximately $18 billion of this debt is expected to be funded at closing in Q1 FY27. PIF will also roll over its existing 9.9 percent stake in Electronic Arts, further aligning long-term incentives.

How will Electronic Arts be structured and managed following the $55 billion transaction?

Upon closing, Electronic Arts will delist from public markets and operate as a privately held company. The headquarters will remain in Redwood City, California, with Andrew Wilson continuing as Chief Executive Officer. Maintaining continuity at the top is seen by analysts as a stabilizing factor, ensuring that Electronic Arts’ creative teams and long-term roadmap are not disrupted by the change in ownership.

Institutional observers expect the company to ramp up investment in immersive technologies, esports ecosystem development, and global market expansion. Freed from quarterly reporting cycles, Electronic Arts may accelerate riskier long-horizon bets, including experimental franchises, deeper integration with physical sports leagues, and leveraging AI to expand personalization in live-service gaming.

What does the Electronic Arts acquisition reveal about the future of gaming industry consolidation?

The $55 billion buyout places Electronic Arts firmly in the narrative of gaming as the new frontier for sovereign wealth and private equity capital. Analysts believe this transaction could spark a new wave of interest in publishers such as Take-Two Interactive, Ubisoft, and Capcom, which may also be considered strategic targets for well-capitalized buyers.

The trend suggests that gaming is being repositioned from entertainment to infrastructure—an essential pillar of the attention economy, social engagement, and global culture. With streaming platforms already absorbing billions in investment and sports leagues securing record broadcast rights, video game publishers are now emerging as similarly indispensable assets. The Electronic Arts transaction illustrates that large-scale institutional money views gaming not merely as cyclical entertainment but as a structural growth market.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.