Corpay, Inc. (NYSE: CPAY), the Atlanta-headquartered corporate payments specialist, has announced a recommended all-cash acquisition of Alpha Group International plc (LSE: ALPH) for an enterprise value of approximately $2.2 billion (£1.6 billion). The deal, which values Alpha at £42.50 per share—a 55 percent premium to its May 1, 2025, closing price—is expected to close in the fourth quarter of 2025, subject to shareholder and regulatory approvals. Corpay reiterated its Q2 2025 guidance and projected the transaction to be accretive to earnings per share by 2026. The company will outline strategic and financial details in an investor call scheduled for 9 a.m. EST today.

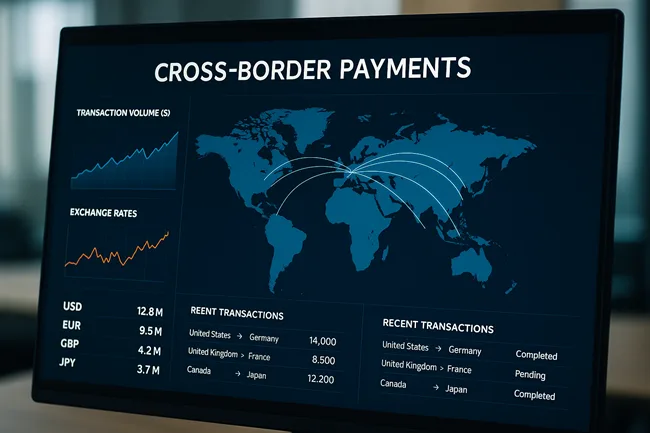

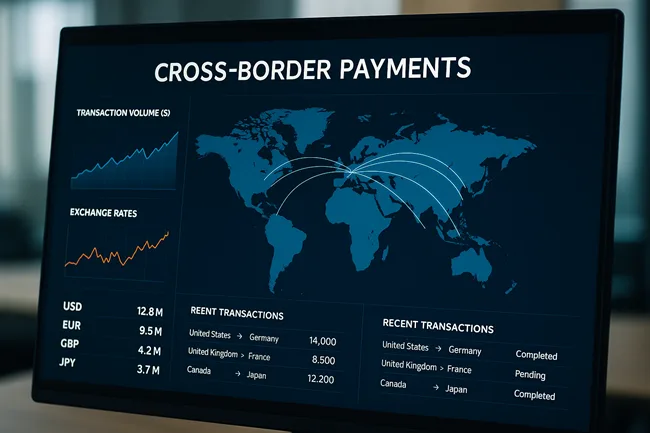

Founded in 2009, Alpha Group International has established itself as a leading provider of B2B cross-border foreign exchange (FX) and alternative banking solutions for corporates and investment funds. The London-based firm holds approximately $3 billion in deposits across more than 7,000 client accounts. Corpay, which rebranded from Fleetcor Technologies, has built its reputation as a corporate payments and commercial card provider, reporting a net income of $1 billion and operating income of $1.79 billion in 2024. Analysts view the transaction as a significant expansion of Corpay’s global cross-border capabilities, particularly in the institutional investor and fund management segments.

What strategic advantages does Corpay expect from acquiring Alpha Group to strengthen its cross-border payment business?

Corpay Chairman and Chief Executive Officer Ron Clarke stated indirectly through the company’s announcement that the acquisition was driven by three strategic factors: Alpha’s strong growth trajectory in corporate payments, its leadership in alternative bank accounts for investment managers, and the opportunity to scale these products beyond Europe into the U.S. and Asian markets. Clarke emphasized that Alpha’s technology would complement Corpay’s existing cross-border solution set while diversifying revenue streams.

Alpha Group Chief Executive Officer Clive Kahn noted in the press statement that Corpay’s global footprint, banking licenses, and technology infrastructure would accelerate Alpha’s growth, especially in institutional investor business. Institutional investors interpreted these statements as a clear signal that Corpay aims to build a dominant non-bank B2B cross-border payment platform capable of rivaling traditional banks.

Analysts believe Corpay is seeking to leverage Alpha’s niche position in alternative banking, which provides investment funds with faster and more cost-effective account services. This is particularly relevant as fund managers increasingly look for non-bank partners to streamline cross-border transactions, a trend driven by stricter regulatory requirements and the demand for operational agility.

How will Corpay finance the Alpha Group acquisition, and what are the implications for its leverage and balance sheet strength?

The acquisition will be financed through a combination of cash, debt, bank capital optimization, and divestitures of non-core assets. While this funding mix will raise Corpay’s leverage in the near term, its robust financial base offers room to absorb the additional debt. Corpay ended 2024 with total assets of $17.9 billion, shareholder equity of $3.15 billion, and a debt-to-equity ratio of 0.29, indicating a conservative balance sheet.

Institutional investors have generally reacted positively to the financial strategy, citing Corpay’s historically strong cash flow and prudent capital management. However, they remain cautious about potential refinancing risks if market conditions tighten. The emphasis will be on how quickly Corpay can generate cost synergies to offset the higher interest burden. Analysts estimate that synergies could contribute approximately $150 million in cost savings and $50 million in additional revenue annually, underpinning Corpay’s projection of meaningful earnings accretion by 2026.

What growth opportunities does the Corpay–Alpha Group combination unlock across geographies and customer segments?

Alpha generated approximately £135.6 million in revenue in 2024, with operating income of £118.3 million and net income of £92.7 million. Its alternative bank account offering is a unique asset, allowing investment managers to hold and move funds efficiently across jurisdictions. Corpay intends to scale this service to the U.S. and Asian markets, leveraging its existing corporate payments network.

Alpha’s 2024 acquisition of Cobase, a multi-bank platform with presence in the Netherlands, Germany, Spain, and Australia, adds another layer of expansion potential. By integrating Cobase’s treasury management capabilities, Corpay could offer multinational clients consolidated FX, banking, and payments services—a significant competitive differentiator in the estimated $2 trillion global B2B cross-border payments market.

Institutional sentiment suggests that Corpay’s existing relationships with corporates, financial institutions, and digital currency providers provide a natural cross-selling opportunity for Alpha’s fund-focused products. Corpay processed $47.9 billion in spend volume in 2024, and analysts expect this acquisition to drive double-digit growth in cross-border transactions.

What regulatory and integration risks could challenge Corpay’s ambitious earnings targets and timeline?

The transaction will be structured as a court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act 2006. Alpha’s board of directors and founder Morgan Tillbrook have unanimously endorsed the deal, with major shareholders signing irrevocable undertakings to vote in favor. However, the acquisition remains contingent on antitrust and regulatory clearances in multiple jurisdictions, which could delay closing or impose conditions.

Integration risk is another concern. The cross-border payments sector has seen mixed success with large acquisitions, where differences in technology infrastructure and compliance processes can slow synergy realization. Rising interest rates and potential FX margin compression could also pressure Corpay’s near-term profitability. Institutional investors are adopting a cautiously optimistic stance, acknowledging the strategic logic but highlighting execution as the primary determinant of success.

What is the long-term outlook for Corpay’s position in the global B2B cross-border payments market after acquiring Alpha Group?

If Corpay achieves its integration and expansion goals, the combined entity could emerge as a leading non-bank cross-border payments provider for corporates and institutional funds. Analysts forecast accelerated revenue diversification and improved operating margins from scale benefits and technology consolidation.

Over the next three to five years, Corpay is expected to strengthen its market share in alternative banking and institutional FX, with a growing presence in the U.S. and Asia. However, sustained success will depend on Corpay’s ability to integrate Alpha without significant disruption, maintain regulatory compliance across jurisdictions, and continuously innovate in a competitive fintech landscape.

The acquisition also signals a broader industry trend: non-bank payment providers are steadily encroaching on traditional banking territory by offering specialized account and foreign exchange services tailored for corporates and institutional investors. These fintech-driven models, often more agile and technology-oriented than conventional banks, are gaining traction because they can deliver faster settlement times, lower transaction costs, and multi-currency account flexibility that traditional banking platforms often struggle to match. Institutional investors are increasingly opting for these non-bank solutions to streamline complex cross-border transactions and improve operational efficiency, particularly in alternative asset classes where rapid fund deployment is critical.

Analysts believe this shift reflects a long-term structural change in the global payments ecosystem, where non-bank providers are no longer viewed solely as ancillary partners but as credible primary platforms for high-value B2B and institutional FX flows. By integrating Alpha Group’s alternative bank account offerings, Corpay is positioning itself at the forefront of this evolution, directly challenging established banks for a larger share of the estimated $2 trillion cross-border B2B payments market. Over time, this competitive dynamic could force traditional banks to accelerate their own technology upgrades or pursue strategic partnerships to defend market share.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.