Why the Irpa tie-back could transform subsea gas economics in the Norwegian Sea

The Irpa development project, which is being tied back to the Aasta Hansteen gas field, is emerging as a pivotal example of how smart subsea tie-back strategies can extend field lifecycles and improve offshore project economics in deepwater environments. Located in the Vøring area of the Norwegian Sea, Irpa is designed to add seven years of life to the Aasta Hansteen gas field through the use of existing infrastructure—without requiring a new host platform or processing facility.

With recoverable volumes of approximately 19.3 billion standard cubic meters (Sm³) of gas and 0.4 million Sm³ of condensate, Irpa has the scale and strategic positioning to influence how operators in Norway and globally think about capital efficiency, emissions, and infrastructure reuse. As of 2025, construction is underway, with first gas expected in 2026.

How is Irpa technically integrated into the Aasta Hansteen gas field infrastructure?

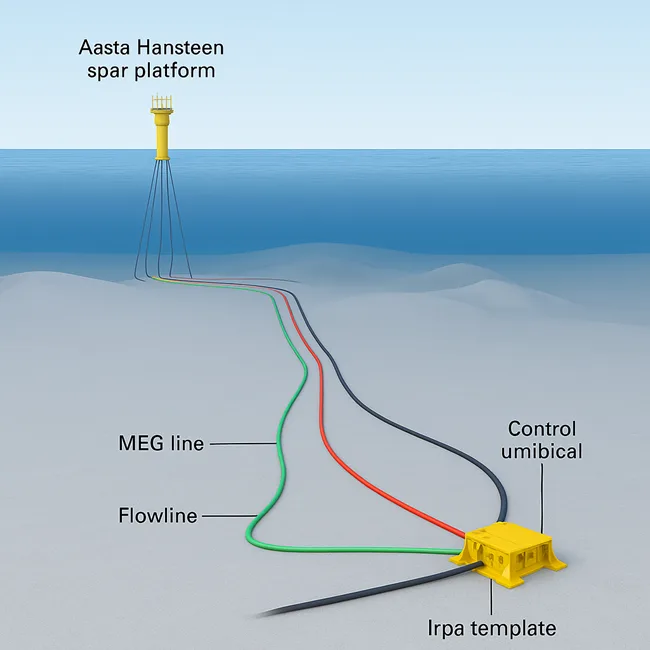

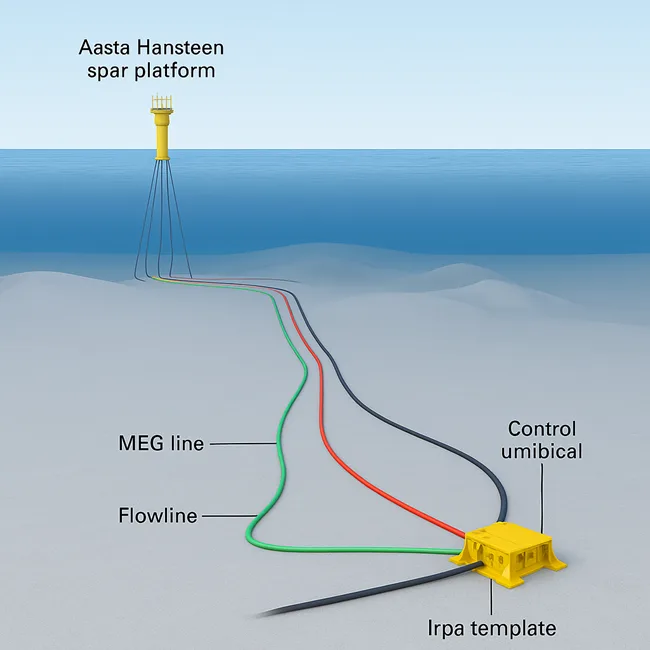

Irpa lies about 80 kilometers west of the Aasta Hansteen gas field in water depths of roughly 1,350 meters. The development plan includes three subsea production wells, tied back to the Aasta Hansteen spar platform through a dedicated 80-kilometer pipeline system. This approach allows Equinor and its partners to bypass the cost and complexity of a new floating production unit.

To ensure stable gas flow under high pressure and cold temperatures, the tie-back system incorporates insulated pipe-in-pipe technology and mono-ethylene glycol (MEG) injection lines. These technologies prevent hydrate formation and maintain flow assurance during both ramp-up and late-life production phases. The use of existing Polarled pipeline capacity and Nyhamna processing infrastructure also minimizes new environmental impact while streamlining export logistics.

What are the expected economic advantages of Irpa compared to greenfield developments?

The Irpa project is expected to cost around NOK 14.8 billion, based on Equinor’s 2022 filings. This represents a materially lower capital expenditure than comparable standalone offshore gas projects, particularly given the remote, Arctic-adjacent location and deepwater conditions. Because Irpa leverages existing facilities at Aasta Hansteen and downstream export pipelines like Polarled, it avoids significant platform, topsides, and pipeline duplication.

According to Equinor, breakeven economics for Irpa are favorable due to the efficiency gains from infrastructure reuse. The project spreads fixed operational costs of the Aasta Hansteen gas field over a longer productive period while adding new revenue-generating volumes. By extending field life to 2039, Irpa also improves asset utilization metrics and helps defer decommissioning liabilities, enhancing project NPV.

Who are the key stakeholders and what is the ownership structure?

As of 2025, Irpa is operated by Equinor with a 51 percent stake. The remaining interest is held by Petoro (20 percent), Wintershall Dea (19 percent), and Shell (10 percent). While Equinor is also the operator of the Aasta Hansteen gas field, the Irpa stakeholder composition introduces a broader coalition of gas players, all of whom benefit from the extended utility of the host platform and export infrastructure.

Petoro, Norway’s state-owned asset manager, plays a key role in aligning the project with national energy strategy objectives. The participation of Shell and Wintershall Dea reflects broader confidence in Norway’s offshore gas systems, particularly in the context of reduced Russian supply to Europe.

What contractors and technologies are being deployed to deliver the Irpa project?

The Irpa tie-back involves a range of Norwegian and international contractors, each focused on minimizing installation risk while maximizing lifecycle performance. Subsea 7 was awarded the engineering, procurement, construction, and installation (EPCI) contract for the subsea pipeline system, including flowlines and control umbilicals. Installation is being conducted with the Seven Vega and other deepwater vessels.

Saipem’s Castorone vessel is handling pipelay operations offshore, which began in 2024 and are expected to complete during the 2025 campaign window. Aibel is responsible for modifications on the Aasta Hansteen spar platform to accommodate Irpa volumes. These modifications include integration of MEG regeneration modules, chemical injection units, and subsea control interfaces.

Optime Subsea has been contracted to deliver its Remotely Operated Controls System (ROCS) to simplify and accelerate subsea well completions in 2026. This reflects Equinor’s focus on reducing installation complexity and cost through automation.

How will Irpa production support Europe’s energy security and transition goals?

Gas from Irpa will flow through the Polarled pipeline to the Nyhamna terminal, where it will be processed and exported to European markets via the Langeled export route. With gas volumes equivalent to powering approximately two million UK homes annually, Irpa contributes directly to the European Union’s efforts to diversify supply, stabilize prices, and reduce dependence on higher-emission fuels.

The project’s tie-in strategy also aligns with REPowerEU and Norwegian climate targets, by avoiding the emissions associated with new platform construction and minimizing incremental CO₂ output per unit of gas produced. Because both Aasta Hansteen and Irpa produce dry gas with minimal processing, their lifecycle emissions remain below the EU taxonomy thresholds for natural gas infrastructure.

How does Irpa compare with other 2026-era subsea tie-backs globally?

Irpa is part of a growing class of late-2020s subsea tie-back projects characterized by deepwater deployment, digital controls, and hub-based infrastructure use. Comparable projects include Shell’s Crux tie-back to Prelude in Australia, OMV’s Berling development in the Norwegian Sea, and BP’s Seagull tie-back to the ETAP platform in the UK North Sea.

What makes Irpa distinctive is its location—among the most remote and deep offshore gas plays in the developed world—and its ability to plug directly into one of Norway’s largest and most advanced export pipelines. The technical and economic model of Irpa is increasingly seen as a blueprint for high-latitude, low-emission gas monetization.

What risks or uncertainties could affect Irpa’s execution or performance?

While the economic and strategic case for Irpa is strong, several execution and operational risks remain. These include weather-related delays during pipelay and subsea equipment installation, particularly given the project’s exposure to Arctic storm cycles. Equinor has scheduled most offshore activity for late summer and early autumn to mitigate these risks.

Another challenge lies in reservoir performance and flow assurance. While the Nise Formation reservoirs at Irpa are considered high quality, real-world flow rates and pressure support will need to be confirmed after first gas. Additionally, the long tie-back length increases the risk of hydrate formation and temperature drops—necessitating robust MEG and insulation design.

Cost inflation, particularly in the global subsea market, may also affect final capex delivery. However, fixed-price contracts and modular architecture mitigate this exposure.

Could Irpa establish a new benchmark for deepwater project returns in Norway?

Yes. The Irpa project demonstrates how existing infrastructure can be strategically used to unlock new reserves, extend field life, and enhance capital productivity. When compared to greenfield developments of similar size, Irpa’s lower capex, reduced emissions, and faster time to market create a compelling investment case.

Moreover, as Norway seeks to maximize resource recovery from its northern basins, the ability to turn spar platforms like Aasta Hansteen into long-term hubs for future tie-ins could increase the strategic and commercial value of existing deepwater assets. If Irpa performs as planned, it could influence investment decisions on other underutilized discoveries nearby, triggering a new phase of “infrastructure-led exploration.”

What Irpa means for the future of the Aasta Hansteen gas field

The Aasta Hansteen gas field was once a standalone deepwater project at the edge of the Arctic. With Irpa, it evolves into a regional subsea hub that could serve Norway’s offshore strategy well into the next decade. The tie-back not only extends production to 2039—it transforms Aasta Hansteen from a high-cost frontier asset into a fully optimized, multi-field host platform.

For investors, policymakers, and engineers alike, Irpa offers proof that innovation in subsea architecture and asset reuse can unlock meaningful gas volumes, support Europe’s energy transition, and deliver durable economic value—even in the most challenging offshore environments.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.