Bioresorbable, drug-eluting nasal implants are emerging as a powerful new strategy to address chronic rhinosinusitis (CRS) and chronic allergic rhinitis (CAR), conditions that have long been plagued by poor patient adherence to treatment. The concept is straightforward: instead of relying on patients to self-administer corticosteroids daily via sprays or rinses, clinicians can now place biodegradable scaffolds that slowly release drugs over weeks or months. These scaffolds dissolve naturally, removing the need for retrieval or repeat intervention.

This “insert and forget” model is now at the forefront of ENT innovation. With companies like Medtronic and Dianosic commercializing and co-developing such implants, analysts believe the broader chronic care segment may be on the cusp of a compliance-driven transformation. The most recent push came with Aptar Pharma’s September 2025 announcement that it would co-develop the Active Resorbable Intranasal Scaffold (ARIS) platform with French biotech company Dianosic. This move signals that drug delivery specialists are seeing long-term potential in implantable, bioresorbable formats for ENT indications—and potentially beyond.

What are bioresorbable drug-eluting implants, and how are they used in chronic rhinosinusitis?

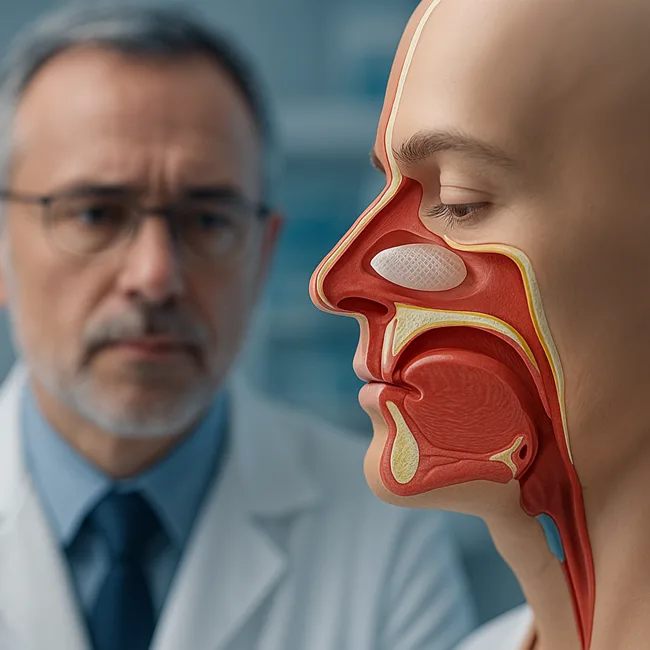

Bioresorbable, drug-eluting implants are small polymer-based devices that are inserted into the sinus cavity after endoscopic sinus surgery (ESS) or in-office procedures. They serve a dual purpose: mechanically keeping the inflamed sinus passage open while simultaneously delivering corticosteroids directly to the affected tissue.

One of the first widely adopted platforms in this space was the PROPEL sinus implant, developed by Intersect ENT and now owned by Medtronic. PROPEL is FDA-approved to release 370 micrograms of mometasone furoate over approximately 30 days. It biodegrades completely within the nasal cavity, and no removal is typically required. Medtronic offers several PROPEL variants—Mini and Contour—targeting different sinus anatomies such as the ethmoid and frontal sinuses.

Another notable platform is SINUVA, also acquired by Medtronic. Unlike PROPEL, SINUVA is designed for use in patients who have undergone prior sinus surgery but experience polyp recurrence. It delivers a higher corticosteroid dose (1,350 micrograms of mometasone furoate) over a 90-day period and is classified as a drug rather than a device due to its regulatory pathway. Although designed to soften and fall out over time, SINUVA may occasionally require removal depending on mucosal changes.

These implants represent a growing category of post-surgical and non-surgical interventions where passive, localized treatment can offer superior results—without the burden of daily dosing.

Why is compliance a major challenge in chronic sinus disease—and how do implants help?

One of the most persistent barriers in managing CRS and CAR is adherence to long-term treatment plans. Patients are typically prescribed daily intranasal corticosteroids post-surgery or as part of maintenance therapy. However, real-world adherence is poor, with many patients discontinuing use due to inconvenience, nasal irritation, or a simple lack of perceived improvement.

This inconsistent use leads to increased recurrence of nasal polyps, inflammation, and symptoms such as nasal congestion, facial pain, and loss of smell. Ultimately, poor compliance may necessitate revision surgeries, raising both patient risk and healthcare costs.

Bioresorbable drug-eluting implants directly confront this challenge by providing sustained, controlled drug delivery independent of patient behavior. Once inserted, these scaffolds steadily release corticosteroids at therapeutic levels over weeks or months, depending on the design. This passive, intervention-free model reduces the dependency on patient discipline while maintaining clinical efficacy—improving outcomes in both surgical and post-surgical care.

How do current implant platforms like PROPEL and SINUVA perform in clinical settings?

Clinical studies have shown that PROPEL can significantly reduce post-operative complications such as synechiae (adhesions), inflammation, and the need for oral steroids. Randomized intra-patient trials demonstrated that sinus cavities treated with PROPEL experienced fewer complications and improved healing metrics compared to untreated control sides.

Similarly, SINUVA has been evaluated in several trials for its ability to reduce polyp burden and nasal obstruction scores. Patients using SINUVA reported significant improvements in symptom control and quality of life. However, its higher dosage and longer duration also raised some concerns around variability in resorption and the occasional need for manual removal.

Despite these caveats, both products have gained considerable traction in the ENT space. They are especially valuable for patients who are at risk of noncompliance or who have complex sinonasal anatomy that would benefit from localized, passive therapy.

What limitations and reimbursement hurdles do these implants face?

While the clinical benefits are increasingly well-documented, the broader adoption of these devices has been somewhat constrained by reimbursement and classification challenges. Some insurers have classified the use of steroid-eluting sinus stents outside specific indications as investigational or not medically necessary. This has particularly affected access to SINUVA, which is often used in outpatient settings and carries a higher list price than traditional therapies.

Moreover, long-term safety and cost-effectiveness data are still emerging. While the implants reduce the need for daily sprays and revision surgery, the upfront cost is significant. Payers and providers continue to evaluate whether these savings translate into meaningful economic benefits at scale.

For bioresorbable implants to become the standard of care, they must demonstrate not just clinical superiority but also economic value and ease of use in diverse healthcare settings.

What does the Aptar–Dianosic ARIS platform bring to this evolving ecosystem?

The partnership between Aptar Pharma and Dianosic reflects a new phase in the evolution of intranasal implant technology. Their co-developed ARIS platform is built around a resorbable polymer scaffold that delivers medication over an extended period. What sets it apart is its design focus on usability and duration, aiming to combine the convenience of a single-placement device with the safety and precision of controlled release.

According to both companies, the ARIS platform targets not just CRS and CAR, but also exploratory use cases in Nose-to-Brain (N2B) drug delivery—a promising but still underexplored route for treating neurodegenerative and neuropsychiatric conditions.

The ARIS device is intended to meet dual priorities: clinical efficacy for physicians and minimal intervention for patients. With Aptar Pharma’s global footprint, device development ecosystem, and regulatory support capabilities, the ARIS platform may enjoy a faster route to market adoption compared to earlier-stage startups in the space.

For Dianosic, the deal validates its core technology and provides the commercial infrastructure needed to scale its innovation globally.

Could nose-to-brain delivery extend the relevance of these scaffolds beyond ENT?

Perhaps the most forward-looking aspect of the Aptar–Dianosic collaboration is its intent to explore Nose-to-Brain drug delivery. This approach leverages the nasal cavity’s proximity to the brain and olfactory bulb to bypass the blood–brain barrier. It holds promise for delivering neurotherapeutics such as peptides, biologics, or small molecules directly into the central nervous system.

While still at an early stage, this expansion pathway could open entirely new markets for intranasal scaffold technology. If ARIS or future devices can support brain-targeted delivery, they may be used in Alzheimer’s, Parkinson’s, or mood disorders—where systemic delivery often fails due to poor BBB permeability.

From a strategic standpoint, such innovation would allow device makers and pharma companies to co-create combination products tailored to complex CNS indications. That would represent a significant expansion beyond current ENT use cases.

How are investors and chronic care strategists viewing this evolution?

For institutional investors and medtech strategists, the appeal of “insert-and-forget” technologies lies in their ability to transform chronic disease delivery models. With rising interest in patient-centered design and real-world outcomes, bioresorbable scaffolds offer a blend of predictability, compliance assurance, and reduced burden on healthcare providers.

Aptar Pharma’s equity stake in Dianosic suggests a long-term vision to anchor such platforms into its broader drug delivery portfolio. With healthcare systems globally grappling with chronic care costs, these solutions may find increasing support as part of value-based care models.

The strategic direction is clear: minimize patient workload, reduce touchpoints, and ensure sustained efficacy. For ENT, that means scaffolds like PROPEL, SINUVA, and ARIS may become central to how rhinosinusitis is managed over the next decade.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.