How did CoreWeave evolve from Ethereum mining to hyperscale AI infrastructure in under a decade?

CoreWeave Inc. (NASDAQ: CRWV) began in 2017 as a cryptocurrency mining operation focused on Ethereum. Co-founded by Michael Intrator and other Wall Street veterans, the firm originally ran massive GPU rigs optimized for proof-of-work validation. But with Ethereum’s 2022 shift to proof-of-stake and declining profitability in mining, CoreWeave pivoted—strategically refocusing on GPU cloud infrastructure for high-performance computing and artificial intelligence workloads.

By 2019, the American infrastructure provider had launched a specialized cloud platform optimized for AI and visual effects rendering. That pivot gained serious traction in 2023, when CoreWeave secured massive contracts with OpenAI, Microsoft, and other large language model developers. The firm raised billions in debt backed by Nvidia’s H100 and GB200 GPU inventory, culminating in a $1.5 billion IPO in March 2025. In the first quarter of 2025, CoreWeave reported $982 million in revenue—a 420% year-over-year increase—and posted a total closed-loop backlog exceeding $25 billion.

With its GPU-first infrastructure and strategic relationship with Nvidia, CoreWeave carved out a unique niche: a vertically focused AI cloud optimized for generative workloads. This differentiated it from general-purpose hyperscalers like AWS, Azure, and Google Cloud—and set the stage for its biggest move yet.

How did Core Scientific go from crypto bankruptcy to a $9 billion AI infrastructure asset?

Founded in 2017, Core Scientific Inc. (NASDAQ: CORZ) was one of the largest Bitcoin mining firms in the U.S. by energy footprint. It operated over 1 GW of infrastructure across the country, including in Texas, Georgia, North Carolina, and North Dakota. The company went public via SPAC in 2021 and rode the crypto boom until crashing under debt and plummeting token prices in 2022. Core Scientific filed for Chapter 11 bankruptcy in December 2022 with over $1.3 billion in liabilities.

Following court-supervised restructuring, Core Scientific emerged from bankruptcy in 2024 with a leaner balance sheet and a sharper focus on colocation and infrastructure leasing. One of its most important clients was CoreWeave itself, which leased up to 840 MW of capacity to host GPU-based AI clusters. That relationship laid the groundwork for an even deeper integration—culminating in CoreWeave’s decision to acquire Core Scientific outright in July 2025.

What does CoreWeave gain from Core Scientific’s infrastructure and energy assets?

The deal, announced on July 7, 2025, will see CoreWeave acquire Core Scientific in an all-stock transaction valued at approximately $9 billion. Under the agreement, Core Scientific shareholders will receive 0.1235 CoreWeave Class A shares for each share they hold. This represents a roughly 66% premium over Core Scientific’s closing price on June 25 and values the firm at $20.40 per share.

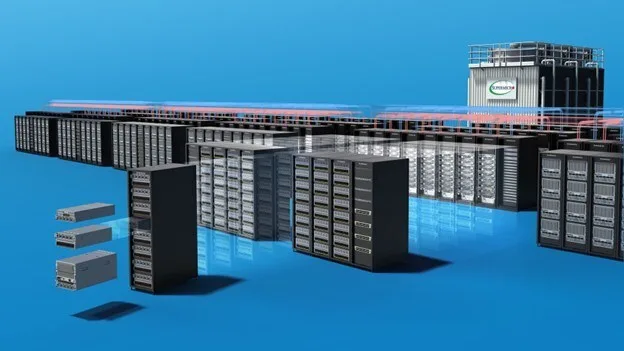

Upon closing, CoreWeave will gain full ownership of approximately 1.3 GW of gross power capacity across Core Scientific’s data center footprint, including the 840 MW it was previously leasing. An additional 1 GW+ in expandable power capacity is also included in the deal.

By eliminating over $10 billion in future lease payments and securing power infrastructure in perpetuity, CoreWeave positions itself to control not just compute—but energy, land, and facility operations as well. The firm expects to realize $500 million in fully ramped annual cost savings by the end of 2027, driven by operating efficiency and financing optimization.

This vertical integration strategy mirrors the early AWS playbook, but purpose-built for AI rather than enterprise IT. As power constraints emerge globally, especially in regions with concentrated GPU demand, ownership of data center real estate and energy procurement rights could become a long-term competitive moat.

How has the market reacted to the $9 billion deal, and what’s the investor sentiment?

CoreWeave’s share price, which peaked near $187 in June 2025 after its IPO debut at $40, has pulled back slightly to around $161 following the acquisition announcement. The dip reflects investor concern about share dilution—Core Scientific shareholders will own less than 10% of the combined entity post-close—as well as the challenge of integrating crypto-era facilities into a next-generation AI stack.

Core Scientific shares, meanwhile, fell by nearly 20% after the deal was announced, even though the $20.40 implied acquisition price offered a significant premium. Analysts attribute this to skepticism around long-term upside and uncertainty about the combined entity’s debt load and integration costs.

Still, institutional sentiment around CoreWeave remains broadly optimistic. The firm is one of the only vertically integrated AI infrastructure providers with Nvidia’s direct support, and its multibillion-dollar contracts with OpenAI, Microsoft, Meta, and others provide strong recurring visibility. While caution remains about capital expenditures and execution risk, many investors see CoreWeave as the potential “AWS of generative AI.”

Can crypto-era infrastructure really be repurposed for AI workloads at scale?

Core Scientific’s footprint is largely composed of energy-intensive, containerized data centers originally designed for ASIC-based Bitcoin mining. However, many of these sites already host GPU clusters for CoreWeave, making them readily convertible for AI and HPC workloads.

The main challenges lie in cooling retrofits, network re-architecture, and sustainability upgrades. AI workloads are more power-dense and thermally demanding than crypto mining, requiring precision air or liquid cooling, fiber-level bandwidth, and sophisticated scheduling. That said, the base-level power access and rural real estate provide a foundation unmatched by most newer firms.

Environmental, social, and governance (ESG) compliance will be a crucial factor going forward. CoreWeave has stated its commitment to expanding renewable sourcing and carbon-offsetting where possible, but repurposing legacy crypto sites may attract regulatory scrutiny in certain states.

How does this move position CoreWeave against hyperscalers and GPU-focused rivals?

The deal catapults CoreWeave ahead of most AI-specialized infrastructure providers in both scale and autonomy. Unlike AWS or Google Cloud, which operate multipurpose platforms, CoreWeave offers single-purpose infrastructure built specifically for AI model training, inference, and fine-tuning. Its bare-metal GPU architecture allows it to offer 20–50% performance improvements over traditional cloud services, according to early customer feedback.

Its technical lead is also enhanced by early access to Nvidia’s GB200 NVL72 superchips and rack-scale deployments expected later this year. The acquisition boosts CoreWeave’s ability to deploy those racks quickly without being bottlenecked by power procurement or colocation leases.

However, it still faces competition from giants like Microsoft Azure—which has built-in demand via OpenAI—and from startups like Lambda Labs and Crusoe Energy, who are also verticalizing their AI cloud stacks. CoreWeave’s ability to maintain pricing power, utilization rates, and rapid deployment will be key to retaining its current growth trajectory.

Why does this acquisition mark a turning point in AI infrastructure strategy?

The $9 billion CoreWeave–Core Scientific transaction marks a structural shift in how AI infrastructure will be built and financed over the next decade. In an era where compute power is the new oil, control over land, energy, and data center operations has become just as important as having the fastest GPUs.

CoreWeave’s vertical integration signals a broader movement: from leasing to owning, from hyperscale generalization to AI-specific design, and from hardware constraints to strategic control. It also confirms that the future of AI infrastructure won’t be decided solely by traditional cloud players but will include emerging hyperscalers with deep integration between capital markets, semiconductor partners, and energy assets.

For investors and industry watchers, CoreWeave’s acquisition strategy offers a blueprint—and a bellwether—for how the next generation of AI infrastructure leaders will scale in a resource-constrained world.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.