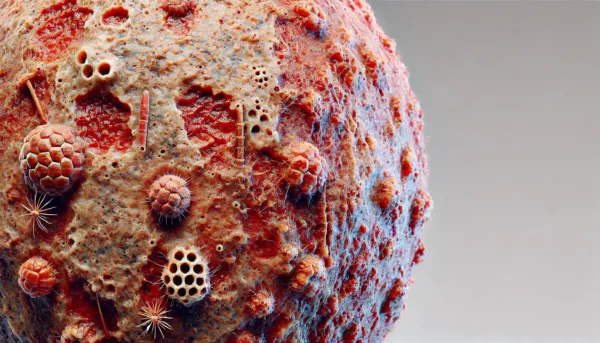

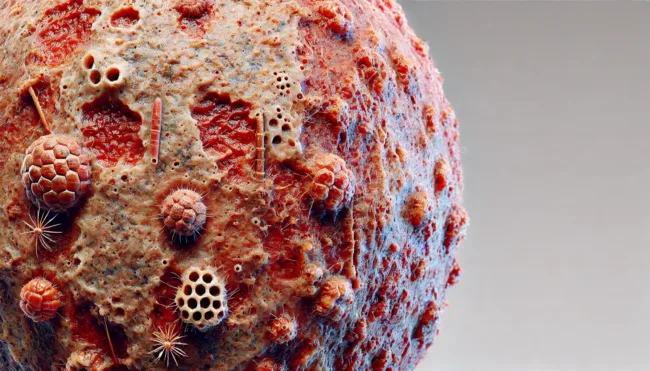

Eli Lilly and Company (Lilly) has secured approval from the U.S. Food and Drug Administration (FDA) for its new biologic treatment, EBGLYSS (lebrikizumab-lbkz), for moderate-to-severe atopic dermatitis in adults and children aged 12 and older. This biologic drug is positioned as a first-line treatment option, promising substantial relief for patients whose eczema is not well controlled by topical treatments. The approval is based on strong clinical trial results demonstrating that EBGLYSS provides significant skin clearance as early as four weeks and meaningful itch relief in just two weeks. This breakthrough has the potential to change the treatment paradigm for eczema sufferers who have limited options.

Strong Market Reaction: Eli Lilly’s Stock Performance

Following the FDA’s approval of EBGLYSS, Eli Lilly and Company, which trades under the ticker symbol LLY on the New York Stock Exchange, experienced a significant market reaction. Recently, the company’s stock was trading at $923.71, slightly down by 1.2% but showing a strong overall performance trajectory in recent months. The stock has been on an upward trend, reaching a 52-week high of $972.53 and showing a consistent increase driven by investor confidence in its innovative product pipeline, including this latest addition of EBGLYSS.

Market sentiment around Eli Lilly’s stock remains bullish, with several financial institutions revising their price targets upward. JPMorgan Chase & Co. recently increased their price target for Eli Lilly’s shares from $1,050.00 to $1,100.00, maintaining an “overweight” rating. Other firms like Berenberg Bank and Guggenheim have also boosted their price targets, indicating positive expectations for the company’s growth prospects with this new drug in its portfolio. The average price target among 19 analysts is around $977.35, suggesting a potential upside of approximately 5.81% from its current price, highlighting strong confidence in the stock’s future performance despite minor fluctuations.

Expert Opinion: A Potential Game Changer for Eczema Treatment

The approval of EBGLYSS has generated optimism among dermatologists and healthcare professionals. Jonathan Silverberg, a professor of dermatology at George Washington University and a leading researcher in the drug’s clinical trials, remarked that this new biologic offers “a much-needed new option for patients struggling with insufficient disease control.” As a first-line biologic targeting the IL-13 pathway, EBGLYSS is expected to provide relief to a substantial patient population that suffers from moderate-to-severe eczema, which can be debilitating and impact daily quality of life.

Strategic Moves: Market Penetration and Accessibility

Eli Lilly is strategically positioning EBGLYSS to capture a significant share of the eczema treatment market. The company plans to collaborate with insurers and healthcare providers to ensure that EBGLYSS is accessible to a broad range of patients. Lilly’s comprehensive support system, Lilly Support Services, aims to remove financial barriers through co-pay assistance and other support mechanisms. This is part of a broader strategy to make the treatment affordable and widely available, thereby accelerating its market adoption.

Sentiment Analysis: Investor Confidence and Cautious Optimism

While the approval of EBGLYSS has undoubtedly buoyed investor confidence, analysts suggest cautious optimism. The pharmaceutical market is highly competitive, particularly in the immunology and biologic sectors. Eli Lilly’s ability to demonstrate long-term benefits of EBGLYSS over current treatments and to effectively manage pricing will be crucial in determining the drug’s success in the marketplace. The next few quarters will be critical as investors closely monitor the uptake and real-world effectiveness of this new treatment.

Eli Lilly’s Next Big Bet in Dermatology

With FDA approval in hand, Eli Lilly is poised to make significant strides in the dermatology space, leveraging EBGLYSS’s clinical success and innovative approach. The company’s strategic focus on accessibility and affordability could make EBGLYSS a blockbuster drug. However, only time will tell whether this new biologic treatment will meet its potential as a game changer for eczema sufferers and a strong growth driver for Eli Lilly.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.