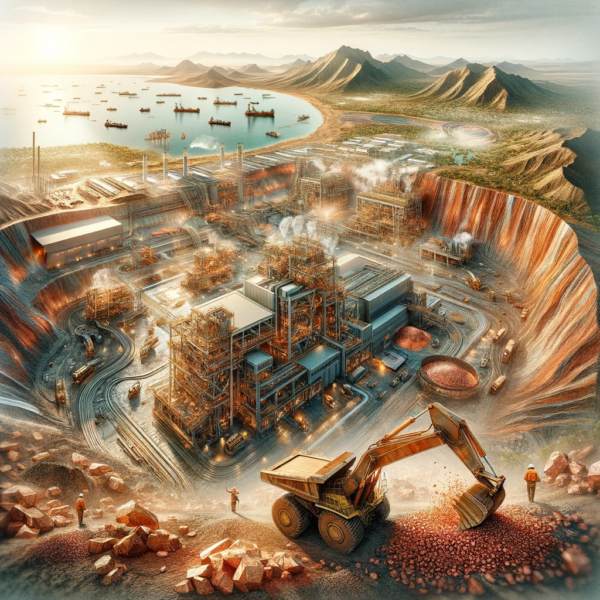

MMG Limited has entered into a Share Purchase Agreement (SPA) to acquire the parent company of the Khoemacau Copper Mine in Botswana. The deal, valued at an effective Enterprise Value of US$ 1.875 billion, marks a significant move for MMG in aligning with its strategy to develop a portfolio of high-quality mines.

Key Highlights of the Acquisition

- MMG anticipates an annual copper equivalent production of 50 to 65 thousand tonnes, with a near-term expansion to 135 to 155 thousand tonnes.

- The Khoemacau Mine promises a long operational life of over 20 years, with C1 costs post-expansion in the lower half of the cost curve.

- The acquisition includes a vast tenement package in the Kalahari Copper Belt, rich in mineral resources with 6.4 million tonnes of contained copper and 263 million ounces of contained silver.

MMG Chairman Jiqing Xu stated, “The acquisition of Khoemacau mine is an important step in achieving our vision of creating a leading international mining company for a low carbon future.” The move is expected to add meaningful long-term value for shareholders, with the Khoemacau mine being a high-quality operating mine located in a highly prospective mining region.

MMG Interim CEO Liangang Li emphasized the company’s strong growth outlook and the role of Khoemacau’s current owners in advancing the mine from exploration to operation.

Expansion and Future Prospects

- The focus now shifts to a feasibility study for increasing production capacity and further exploration opportunities across the license area.

- The acquisition is set to complete in the first half of 2024, subject to certain conditions precedent and approvals.

Khoemacau Copper Mining CEO Johan Ferreira expressed excitement for the future under MMG, highlighting the potential for doubling production and the significant investment needed to realize Khoemacau’s full potential.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.