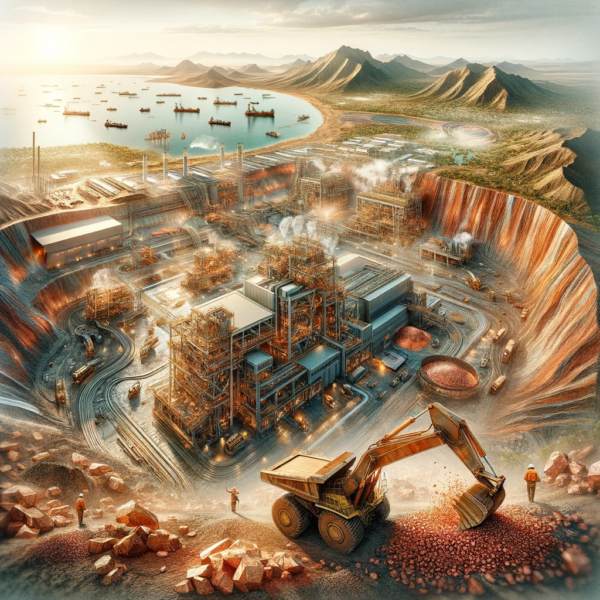

Lundin Mining acquisition of Chapada copper mine : Lundin Mining, a Canadian base metals mining company, has wrapped up its previously announced acquisition of 100% stake in Mineração Maracá Indústria e Comércio, the holding company of the producing Chapada copper mine in Brazil, for more than $1 billion, from Yamana Gold.

As per the terms of Lundin Mining acquisition of Chapada copper mine, announced in mid-April, Yamana Gold will be paid $800 million and up to $225 million as contingent payment.

The Canadian gold, silver and copper producer will retain a 2.0% net smelter return (NSR) royalty on gold production from the Suruca gold deposit at the Chapada copper mine in the future. It will be entitled to contingent payment of up to $125 million for five years if some gold price thresholds are met and $100 million in contingent consideration based on the construction of a pyrite roaster.

Commenting on Lundin Mining acquisition of Chapada copper mine, Jason LeBlanc – Chief Financial Officer of Yamana Gold, said: “When we announced the sale of Chapada, we said that we would use the proceeds to immediately pay down debt. With the sale now closed, we are doing exactly what we said we were going to do.”

“With our improved financial flexibility and a more favourable gold price environment, we are well positioned to benefit from the contingent payments that are part of the Chapada sale, advance organic growth opportunities like the Jacobina phased expansion, increase cash flow, and further reduce debt.”

The Chapada copper mine, which is located in Goiás State, has been producing since 2007. The Brazilian copper-gold mine is estimated to produce nearly 54.5 kt of copper and 100 kozs of gold, or around 75 kt of copper equivalent in 2019.

Marie Inkster – President and CEO of Lundin Mining, commenting on Lundin Mining acquisition of Chapada copper mine, said: “The addition of Chapada further solidifies Lundin Mining’s position as a leading intermediate base metals producer. We look forward to establishing an excellent reputation in Brazil as we work closely with our new employees and stakeholders.

“Leveraging our technical expertise, base metals focus and financial strength, we believe further opportunities exist to create meaningful stakeholder value from this high-quality asset.”

In May 2019, Lundin Mining said that Freeport Cobalt, its joint venture with Freeport-McMoRan, has signed a deal to sell its Kokkola Cobalt Refinery in Finland and associated cobalt cathode precursor business to Umicore for around $150 million.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.