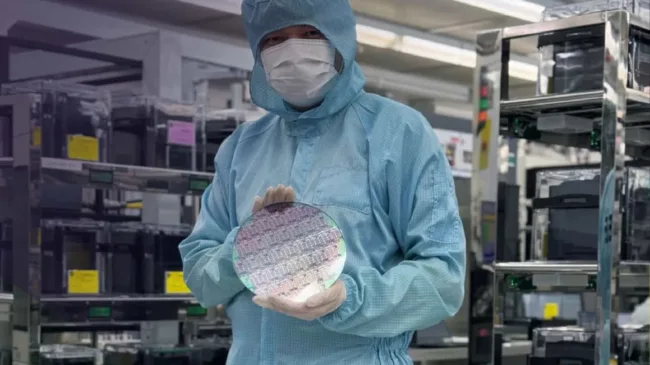

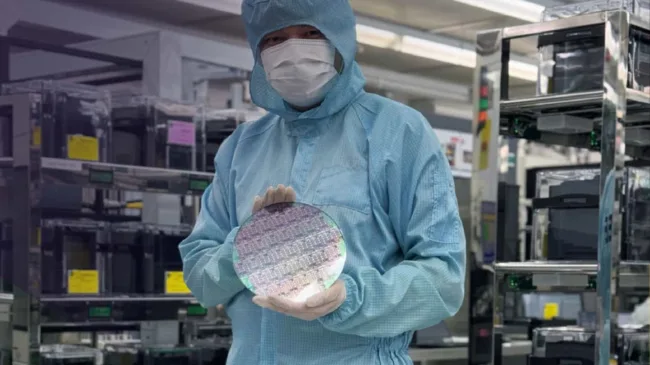

GlobalFoundries (NASDAQ: GFS) has completed the acquisition of Advanced Micro Foundry (AMF) in Singapore, cementing its position as the largest pure-play silicon photonics foundry and accelerating its push into AI data infrastructure markets across the globe.

GlobalFoundries has taken a definitive step in strengthening its presence in high-performance optical interconnects with the acquisition of Advanced Micro Foundry, a specialty silicon photonics manufacturer based in Singapore. Announced on November 17, 2025, the acquisition is a strategic move to meet rising global demand for ultra-fast, energy-efficient data transfer across AI datacenters, communications infrastructure, quantum computing, and automotive technologies.

The acquisition adds not just production capacity but also critical intellectual property and more than 15 years of domain-specific expertise. GlobalFoundries said it would integrate Advanced Micro Foundry’s operations into its existing global footprint and begin expanding manufacturing from the current 200mm wafer process to 300mm over time, reflecting the need to scale as AI deployments become increasingly bandwidth intensive.

By combining this acquisition with its U.S.-based silicon photonics efforts in New York, GlobalFoundries now operates silicon photonics capacity across multiple continents, allowing it to offer resilient supply chain options for AI hardware customers and optical networking clients.

Why silicon photonics is central to AI infrastructure in 2026

With the rise of large language models, vector databases, and real-time inference systems, traditional copper-based interconnects are no longer able to meet the physical, thermal, and latency demands of AI clusters. Silicon photonics has emerged as the dominant alternative, enabling data to move at significantly higher speeds using light instead of electricity. The technology is essential for both intra-datacenter and inter-datacenter communication, providing lower power consumption and higher bandwidth per connection.

GlobalFoundries Chief Executive Officer Tim Breen described the deal as a decisive step toward enabling a differentiated decade-long roadmap in photonics, encompassing pluggable transceivers and co-packaged optics. According to Breen, silicon photonics will play an increasingly critical role in next-generation telecom, quantum computing, and automotive sectors. He emphasized that AI datacenters, in particular, will benefit from the company’s expanded photonics capabilities as customers seek more secure and power-efficient ways to move massive datasets across AI compute nodes.

This strategic shift reflects a broader trend in semiconductor manufacturing where connectivity bottlenecks, not compute speed, are becoming the limiting factor in AI system performance. Analysts tracking hyperscaler capex believe the shift to photonic interconnects will accelerate through 2026 as leading cloud providers standardize on 400Gbps and 800Gbps optical modules for AI workloads.

What capabilities does GlobalFoundries gain through the AMF acquisition?

Advanced Micro Foundry has been one of the few pure-play foundries focused exclusively on silicon photonics. Its operations include prototyping, device manufacturing, and testing services supported by in-house Process Design Kits. These toolkits, optimized for telecom, datacenter, LiDAR, and sensor applications, have enabled Advanced Micro Foundry to develop and ship commercial photonic devices across Asia and Europe.

By acquiring Advanced Micro Foundry, GlobalFoundries gains access to these proprietary platforms, a mature 200mm production line in Singapore, and a highly skilled engineering team with deep experience in photonic design and integration. The acquisition will allow GlobalFoundries to address both current and future optical needs across AI, cloud, and telecom segments while enhancing its ability to deliver differentiated solutions for new markets such as automotive LiDAR and quantum photonic computing.

The Singapore site also strengthens GlobalFoundries’ strategic positioning in Asia. It provides customers with an alternative manufacturing location outside of the U.S., reinforcing regional supply chain resilience in line with customer demand for geographic diversity in AI infrastructure sourcing.

What role will the Singapore Center of Excellence play?

To build on this acquisition, GlobalFoundries announced plans to establish a silicon photonics Center of Excellence in Singapore. This center will collaborate with Singapore’s Agency for Science, Technology and Research (A*STAR) to accelerate the development of next-generation photonics materials and fabrication technologies. The initial focus will be on enabling data transfer speeds of 400Gbps and higher, aligning with the trajectory of AI infrastructure scaling in cloud, telecom, and enterprise applications.

The research collaboration will support GlobalFoundries’ roadmap to deliver secure and high-performance optical data solutions with lower latency and improved power efficiency. In a region that has already attracted significant semiconductor R&D investment, the Center of Excellence is expected to contribute to workforce development, ecosystem innovation, and design-to-manufacturing optimization.

This move further reinforces Singapore’s role as a semiconductor hub in Southeast Asia. The country has increasingly attracted interest from global players seeking stable policy environments, skilled talent pools, and advanced infrastructure for high-precision manufacturing and packaging technologies.

How does the acquisition position GlobalFoundries against competitors?

With the completion of this deal, GlobalFoundries has emerged as the largest pure-play silicon photonics foundry in terms of revenue, positioning itself ahead of vertically integrated rivals that offer photonics as part of a broader portfolio. The firm’s photonics strategy now spans from IP development and R&D to volume production and packaging, offering customers a complete design-to-delivery pipeline.

This level of specialization differentiates GlobalFoundries from players like Intel, which has internal photonics capabilities, and Taiwan Semiconductor Manufacturing Company, which supports photonics integration for select customers but does not operate as a pure-play foundry in this segment. Other emerging competitors in photonics include Tower Semiconductor and AIM Photonics, but none currently match GlobalFoundries’ scale or geographic reach following the AMF acquisition.

Jagadish CV, Chief Executive Officer of Advanced Micro Foundry, stated that the acquisition aligned with both companies’ customer-centric vision. He described the move as an opportunity to extend the impact of silicon photonics across a wider range of applications and clients. Analysts said the acquisition could improve GlobalFoundries’ ability to meet demand from hyperscalers and original equipment manufacturers looking for photonics-enabled AI solutions that can be tailored to unique data movement challenges.

How are investors responding to the deal and what will they watch next?

GlobalFoundries has positioned this acquisition as part of a multi-year investment strategy into specialty technologies that go beyond traditional CMOS. In addition to silicon photonics, the company has been expanding its capabilities in radio-frequency, low-power, and automotive-grade semiconductors.

Investor reaction to the acquisition has been cautiously positive, with market participants awaiting more details on integration timelines, revenue contribution, and capital expenditure. As of the five-day trading window prior to the announcement, GlobalFoundries shares had shown minor gains. Analysts noted that the real investor focus will be on how quickly the company can move AMF’s platform to 300mm wafer production and how soon those photonics solutions begin contributing to revenue.

Buy-side institutions following AI infrastructure trends generally see photonics as a must-have capability for advanced foundries. While questions remain about margin impacts and time-to-market, the acquisition is being interpreted as a strategic rather than opportunistic buy. Institutional investors will also be looking at pipeline development tied to AI hyperscalers, automotive OEMs, and emerging quantum tech partners.

What does this deal signal for AI infrastructure markets going forward?

The GlobalFoundries–Advanced Micro Foundry deal sends a clear signal that silicon photonics is no longer niche. It is now considered a central pillar of AI infrastructure, with real manufacturing scale and institutional capital flowing into its development.

As compute hardware continues to evolve with more cores, accelerators, and memory-intensive workloads, the bottlenecks are increasingly found in data movement. Optical interconnects enabled by silicon photonics offer a scalable path to overcoming these constraints. Foundries that can offer multi-region manufacturing and integrate photonics with advanced packaging are likely to play an outsized role in shaping AI infrastructure over the next five years.

In that context, GlobalFoundries is now well-positioned not only as a manufacturer but also as a systems enabler for the next wave of compute and connectivity technologies. With this acquisition, the American semiconductor firm has committed to photonics in a way that aligns with long-term AI trends, giving customers greater flexibility and global sourcing options.

What are the key takeaways from GlobalFoundries’ acquisition of Advanced Micro Foundry?

- GlobalFoundries has acquired Singapore-based Advanced Micro Foundry, establishing itself as the world’s largest pure-play silicon photonics foundry by revenue.

- The acquisition expands GlobalFoundries’ capabilities in manufacturing, intellectual property, and photonics design, adding a mature 200mm platform with plans to scale to 300mm.

- The deal strengthens GlobalFoundries’ position in high-speed optical data transfer for AI infrastructure, long-haul telecom, LiDAR, quantum computing, and automotive markets.

- A new silicon photonics Center of Excellence will be launched in Singapore in partnership with A*STAR to develop ultra-fast data transfer solutions, starting with 400Gbps technologies.

- With this move, GlobalFoundries gains a critical foothold in Asia, enabling a more geographically diverse and resilient supply chain for hyperscalers and OEMs.

- Analysts view the acquisition as a strategic play that aligns with rising demand for energy-efficient AI datacenter interconnects, though investors await clarity on revenue contribution and 300mm wafer transition timelines.

- Industry observers expect GlobalFoundries to compete more directly with integrated players like Intel and Taiwan Semiconductor Manufacturing Company as hyperscalers seek photonics-first manufacturing partners.

- The acquisition reinforces the broader semiconductor shift toward integrating photonics with AI hardware to overcome bandwidth, latency, and thermal limitations in future datacenter architectures.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.