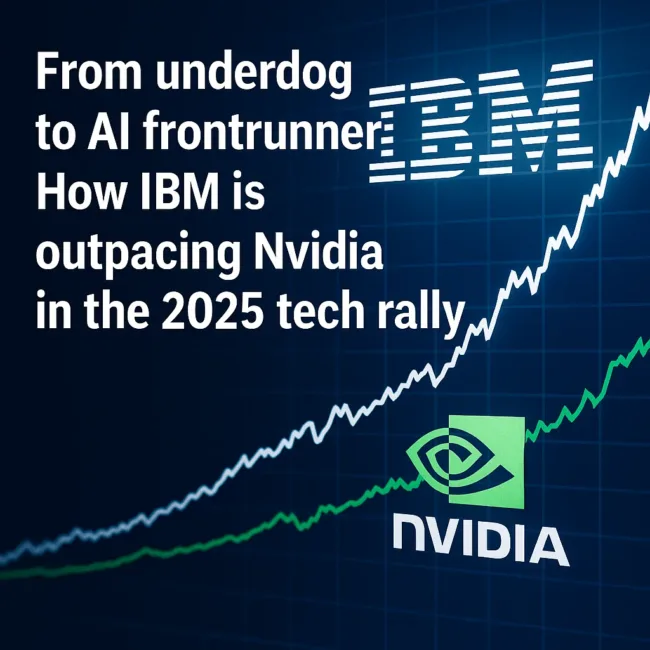

International Business Machines Corporation (IBM) has emerged as one of 2025’s most unexpected outperformers, beating out NVIDIA Corporation in year-to-date stock gains and signaling a shift in investor preference within the artificial intelligence boom. The broader story unfolding is not just a matter of trading percentages. It reflects how the market is beginning to distinguish between foundational AI infrastructure companies and enterprise-ready AI monetization players.

According to the latest data through November 7, 2025, IBM shares have risen approximately 44.99 percent since the beginning of the year, slightly ahead of NVIDIA Corporation, which has gained around 40.06 percent over the same period. For a company long perceived as a legacy tech brand, this is a notable inflection point. IBM is being rewarded not for flash, but for focus. Its aggressive push into generative artificial intelligence, hybrid cloud services, and infrastructure automation is resonating with institutions and value-focused investors looking beyond chipmakers.

What is even more telling is the composition of the rally. While NVIDIA Corporation continues to dominate headlines with its role in powering large language models and hyperscale data centers, IBM is winning business in the unsexy but highly profitable world of enterprise AI deployment where integration, compliance, and long-term transformation matter more than speed alone.

How has IBM’s pivot toward enterprise AI and hybrid cloud driven its stock performance in 2025?

Several strategic milestones explain the sharp upward trajectory for IBM in 2025. One key catalyst has been the company’s fast-expanding enterprise AI business. By mid-year, it disclosed that its generative artificial intelligence offerings had crossed the USD 7.5 billion mark in total bookings, up from around USD 6 billion just two months earlier. That acceleration has helped convince investors that the company’s shift toward monetizable, production-ready artificial intelligence solutions is not a marketing play but a revenue engine.

Another tailwind has come from acquisitions that strategically align with the needs of enterprise customers adopting artificial intelligence. In February 2025, IBM announced a USD 6.4 billion acquisition of HashiCorp, adding leading tools such as Terraform and Vault to its hybrid cloud and infrastructure automation portfolio. These tools help large clients manage complex multicloud environments and bring automation and security into cloud workflows, which are areas that directly benefit from artificial intelligence integration.

Perhaps just as importantly, the company’s valuation remains relatively modest. At the time of writing, IBM trades at a forward price-to-earnings multiple of roughly 23.9x. In contrast, NVIDIA Corporation commands a premium multiple near 29.9x, reflecting both high expectations and vulnerability to corrections. Investors looking for margin of safety in the AI space may now view IBM as the more balanced, cash-generating bet.

Why are regulatory risks and hyperscaler spending trends weighing on Nvidia’s stock performance?

While NVIDIA Corporation remains the uncontested leader in AI training hardware, powering nearly all major foundation models and dominating the global GPU market, cracks are emerging in the narrative of infinite growth. Several regulatory and macroeconomic headwinds have begun to weigh on investor sentiment.

Chief among them is the expanding web of United States export controls targeting the sale of advanced semiconductors to China and other regions. These curbs have already led to delayed shipments, order reshuffling, and growing geopolitical uncertainty around future market access. With China representing a key demand center for advanced chips, any contraction in export volumes could have a material impact on revenue forecasts.

Additionally, the capital intensity of the current AI supercycle is beginning to raise questions. Hyperscale cloud providers such as Microsoft Corporation, Amazon.com, Inc., and Alphabet Inc. are investing billions of dollars into custom silicon and infrastructure expansion. However, analysts have noted a slight moderation in procurement cycles in the second half of 2025. If this trend extends into 2026, NVIDIA Corporation could face near-term challenges in sustaining its current growth rate.

At the same time, gross margins remain under pressure. Increased competition from AMD, Intel Corporation, and in-house chips from cloud hyperscalers is creating pricing tension. As customers gain alternatives to NVIDIA Corporation’s CUDA platform, the ecosystem lock-in that once protected its dominance may begin to erode.

Is investor sentiment shifting from hardware-centric to enterprise-centric AI stocks?

Investor behavior in 2025 reflects a more nuanced approach to artificial intelligence. During the 2023–2024 period, the dominant strategy was to back the companies building the infrastructure layer: GPUs, high-bandwidth memory, AI-optimized servers, and foundational model architecture. That wave benefited NVIDIA Corporation, Advanced Micro Devices, Inc., and infrastructure providers.

However, as large-scale model training becomes table stakes and infrastructure buildouts plateau, the market is turning to the monetization layer. This includes companies that help enterprises adopt, govern, and integrate AI into workflows. IBM, ServiceNow, Inc., Salesforce, Inc., and Palantir Technologies Inc. are increasingly seen as beneficiaries of this next leg.

What makes IBM unique among this cohort is its credibility in regulated sectors such as financial services, healthcare, and government. These are industries where artificial intelligence is constrained by compliance and explainability, making IBM’s deep focus on AI governance, data security, and trust frameworks a competitive advantage.

Additionally, the company’s consulting arm gives it a front-row seat to enterprise demand signals. Through large AI transformation projects, IBM gains visibility and influence into where budgets are going, which allows it to cross-sell infrastructure and cloud offerings in ways few rivals can match.

What could change the momentum between Nvidia and IBM in the AI investment cycle?

While the current rally suggests investor rotation, the longer-term race between NVIDIA Corporation and IBM is far from settled. NVIDIA Corporation still commands the most strategically vital part of the AI stack—hardware acceleration. It is deeply embedded in every major model training pipeline, from OpenAI to Meta Platforms, Inc. to Tencent Holdings Ltd.

If hyperscaler spending reaccelerates in 2026 or if NVIDIA Corporation’s software stack becomes more developer-friendly at the inference layer, it could regain momentum. Moreover, strategic partnerships with large system integrators and on-premise AI deployments could create new growth vectors beyond cloud-based training workloads.

For IBM, the key challenge remains sustaining growth in enterprise AI without dilution from legacy lines of business. While its consulting and hybrid cloud platforms are showing resilience, hardware sales and older software licensing models continue to act as a drag.

Another risk is competition from more nimble players. Microsoft Corporation’s Azure OpenAI integrations and Salesforce, Inc.’s Einstein 1 platform are expanding rapidly. If IBM fails to differentiate on verticalization and governance, it could struggle to defend its lead.

In essence, the AI market is entering a phase where infrastructure and monetization strategies are no longer viewed as interchangeable. Companies must now prove they can deliver sustainable revenue, not just model demos or silicon benchmarks.

What does this shift mean for long-term tech investors and institutional capital allocation?

For institutional investors, the rotation from infrastructure to enterprise applications is more than just a short-term trade, it reflects a maturation of the artificial intelligence thesis. It suggests that the market is beginning to favor real-world revenue execution over abstract potential.

IBM fits neatly into that narrative. It offers a stable, cash-rich, dividend-paying alternative to high-multiple, high-volatility names. As a result, it has become more attractive to pensions, sovereign wealth funds, and conservative funds looking for artificial intelligence exposure with lower risk profiles.

Conversely, NVIDIA Corporation remains the bet for investors who believe in exponential upside and are willing to tolerate cyclical volatility. If a new wave of demand emerges such as edge inference, humanoid robotics, or multimodal computing, NVIDIA Corporation could rapidly reclaim market leadership in both fundamentals and sentiment.

For now, the message is clear. Enterprise AI is not a sideshow. It is becoming the main act in the artificial intelligence economy. Investors who overlooked IBM a year ago are now scrambling to understand its strategy, pipeline, and capital allocation priorities.

Key takeaways: Why IBM’s 2025 stock surge over Nvidia signals a deeper AI investment shift

- International Business Machines Corporation has gained nearly 45 percent year-to-date through November 2025, edging past NVIDIA Corporation’s ~40 percent rally.

- IBM’s outperformance reflects growing investor preference for monetizable enterprise AI solutions over chip-heavy infrastructure plays.

- The company’s generative AI bookings jumped to USD 7.5 billion by mid-2025, supported by demand from consulting, hybrid cloud, and regulated enterprise clients.

- IBM’s USD 6.4 billion acquisition of HashiCorp strengthened its automation and multicloud positioning, adding strategic depth to its AI and infrastructure offerings.

- Nvidia continues to dominate the AI hardware stack but faces export restrictions, moderating hyperscaler spending, and competition from AMD and custom silicon.

- IBM’s lower forward P/E ratio (~23.9x vs Nvidia’s ~29.9x) suggests more room for upside via multiple expansion as investors seek stable, lower-risk AI exposure.

- The AI narrative is maturing, with capital rotating from speculative infrastructure spending to production-grade AI deployment and business value realization.

- Institutional investors are increasingly favoring cash-generating, enterprise-centric AI players like IBM for long-term allocation.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.