The U.S. stock market closed higher on August 8, 2025, with the Nasdaq Composite ending at a record high and the S&P 500 advancing, led by strong gains in technology, AI, and select industrial stocks. Investors reacted to earnings beats, raised guidance, and sector-specific catalysts that outweighed concerns about tariffs and sticky inflation.

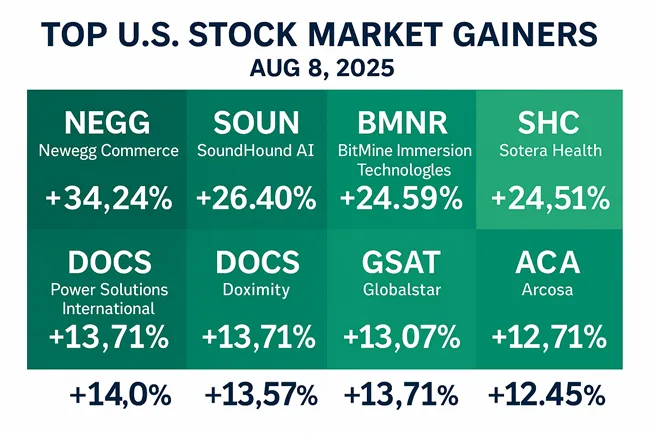

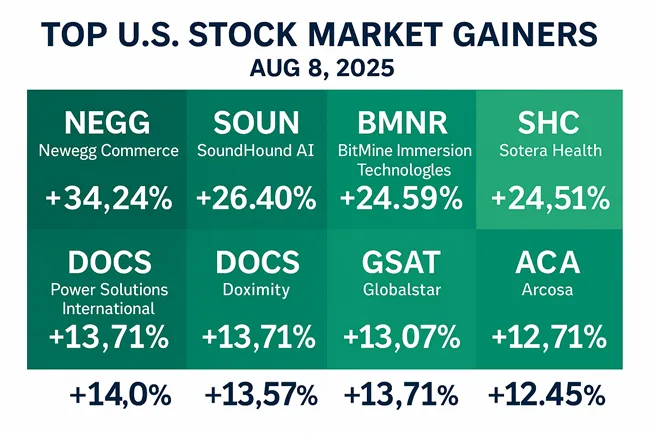

Among the day’s top performing stocks were Newegg Commerce, Inc. (NASDAQ: NEGG), SoundHound AI, Inc. (NASDAQ: SOUN), BitMine Immersion Technologies, Inc. (NASDAQ: BMNR), Sotera Health Company (NASDAQ: SHC), Hagerty, Inc. (NYSE: HGTY), Doximity, Inc. (NYSE: DOCS), Power Solutions International, Inc. (NASDAQ: PSIX), Globalstar, Inc. (NYSE: GSAT), Arcosa, Inc. (NYSE: ACA), and JFrog Ltd. (NASDAQ: FROG).

Why did Newegg Commerce stock rise on Aug 8, 2025?

Newegg Commerce surged 34.24% to $79.79 after launching the Newegg Gamer Community, a platform targeting PC builders and gaming enthusiasts. The announcement, distributed via company press release, aligns with Newegg’s strategy to deepen engagement in high-margin verticals.

Investor sentiment was further boosted by insider purchases disclosed in recent SEC Form 4 filings by Vladimir and Angelica Galkin, totaling millions of dollars’ worth of stock. Heavy trading volumes—1.74 million shares versus a 1.03 million three-month average—amplified momentum.

While the stock’s 392.53% gain over the past year highlights its rally strength, analysts caution that with no P/E ratio and modest earnings visibility, sustainability depends on execution and monetization of the new platform.

Why did SoundHound AI stock jump today after earnings?

SoundHound AI rose 26.40% to $13.55 following second-quarter results showing revenue of $42.7 million, up 217% year-on-year, and narrower losses. The company raised its full-year revenue forecast to $160–$178 million, citing stronger-than-expected enterprise adoption, particularly in automotive integrations.

Average daily volume soared to over 204 million shares—more than five times its 38.75 million three-month average—signaling both institutional buying and retail momentum. The stock’s 107.75% 52-week gain underscores continued market appetite for AI-linked growth stories with improving fundamentals.

What drove BitMine Immersion Technologies’ share price higher?

BitMine Immersion Technologies gained 24.59% to $51.43 after disclosing Ethereum holdings of over 833,000 tokens (about $2.9 billion at the time) and announcing a $1 billion share repurchase authorization. Both disclosures came directly from company press releases.

The rally occurred amid a broader cryptocurrency uptick, with Bitcoin trading above $80,000. Trading volume spiked to over 90 million shares against a 22.31 million average. While the company’s 432.65% annual gain reflects extreme momentum, its recent $2 billion at-the-market offering filing signals significant financing risk alongside its high-reward profile.

Why did Sotera Health rally on raised guidance?

Sotera Health rose 24.51% to $13.97 after reporting Q2 revenue of $294 million, up 6.4% year-on-year, and raising its full-year guidance for both revenue and adjusted EPS. Trading volumes exceeded 4.29 million shares, well above the 1.16 million average.

The gain comes despite the stock’s -21.48% 52-week performance, as investors welcomed improved operational visibility in its sterilization and lab services divisions. However, with a trailing P/E of 127, the company must maintain margin discipline to justify valuations.

What pushed Hagerty stock up despite a secondary offering?

Hagerty gained 14.03% to $10.65 after Q2 results earlier in the week showed first-half revenue growth of 18% and higher net income. The company also raised its full-year outlook.

Shares had dipped following news of an upsized secondary offering by selling stockholders, which did not dilute the company’s balance sheet. Friday’s rebound suggests investors are prioritizing the earnings beat and niche growth profile in collectible vehicle insurance over short-term share supply concerns.

Why did Doximity shares gain after Q1 FY2026?

Doximity rose 13.71% to $66.58 after reporting Q1 FY2026 revenue of $146 million and non-GAAP EPS of $0.36, both above consensus estimates. Management also issued Q2 guidance modestly ahead of expectations, reinforcing confidence in its high-margin physician networking platform.

With a 67.53% 52-week gain, Doximity continues to screen well for institutional quality-growth portfolios, though investors remain mindful of healthcare advertiser spending trends in a mixed macro environment.

What lifted Power Solutions International among U.S. stock market gainers?

Power Solutions International jumped 13.57% to $99.70 after Q2 revenue rose 74% year-on-year to $191.9 million and net income hit $51.2 million. The company also reported debt reduction and the removal of “going concern” language from its financial statements.

The results reaffirm demand strength in industrial and transportation end markets, helping to sustain the stock’s extraordinary 607.41% 52-week gain.

Why did Globalstar stock rise after Q2 results?

Globalstar advanced 13.07% to $28.47 after releasing Q2 earnings and reiterating its outlook. The company remains supported by multi-year agreements with Apple for satellite connectivity in consumer devices—deals that have been publicly disclosed in SEC filings and press releases.

The stock’s 59.50% annual gain and above-average trading volumes on Friday reflect continued investor interest in low-Earth orbit satellite capacity and spectrum monetization potential.

What supported Arcosa’s stock move after record margins?

Arcosa rose 12.71% to $95.92 after posting record Q2 results, including adjusted EBITDA up 42% year-on-year (excluding divestitures) and a record 20.9% adjusted EBITDA margin. Backlog growth in aggregates and utility structures added further support to the bullish outlook.

The company’s focus on higher-margin infrastructure businesses aligns with long-term trends in public works and renewable energy grid upgrades.

Why did JFrog stock pop on strong cloud growth?

JFrog climbed 12.45% to $43.62 after Q2 revenue rose 23% year-on-year to $127.2 million, with non-GAAP EPS of $0.18. Management reported an expanding base of $1 million-plus ARR customers and reiterated its full-year growth outlook.

The results reinforced JFrog’s positioning in DevOps, software supply chain security, and AI-assisted development—key growth themes in enterprise IT spending.

How did broader market trends and institutional investor flows influence the U.S. stock market gainers on Aug 8, 2025?

Friday’s rally was underpinned by tangible catalysts—earnings beats, raised guidance, or material corporate disclosures—across most of the day’s top gainers. Institutional flows favored growth sectors, particularly AI, industrials tied to infrastructure, and specialty technology plays.

The Nasdaq’s record close reflected renewed risk appetite, aided by speculation over potential Federal Reserve rate cuts later in the year. However, tariffs on technology imports and lingering inflation pressures temper the broader outlook.

What key takeaways can investors draw from the Aug 8, 2025 U.S. stock market gainers and their underlying catalysts?

The Aug 8, 2025, U.S. stock market gainers list was dominated by companies delivering hard news rather than rumor-driven spikes. That gives some durability to the moves in Newegg, SoundHound, Doximity, Arcosa, PSIX, and JFrog, provided execution continues. Crypto-linked BitMine remains the outlier: while its Ethereum and buyback disclosures are verifiable, their monetization and governance execution remain high-risk.

With CPI and PPI data due next week, momentum could persist if inflation readings support rate-cut narratives. But after double-digit single-day moves, expect selective profit-taking. Long-only managers are likely to favor names with backlog visibility, recurring revenues, and sector tailwinds.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.