Indegene Limited (NSE: INDGN, BSE: 544172), a digital-first life sciences commercialization partner, has turned investor heads with the recent launch of NEXT Medical Writing Automation, but behind the scenes, it is the underlying engine—Cortex—that is beginning to define the Bengaluru-based firm’s AI advantage. As regulatory complexity rises across global clinical development and commercialization processes, Cortex is emerging as a domain-specific orchestration layer purpose-built for automating life sciences operations.

With NEXT now live for automating clinical and regulatory documentation, Cortex’s capabilities in orchestrating multi-agent AI workflows within GxP environments could elevate Indegene into the higher-margin realm of regulatory tech—a fast-evolving space where domain expertise and compliance fidelity are non-negotiable.

How is Cortex positioned differently from generic AI platforms in managing regulated medical workflows?

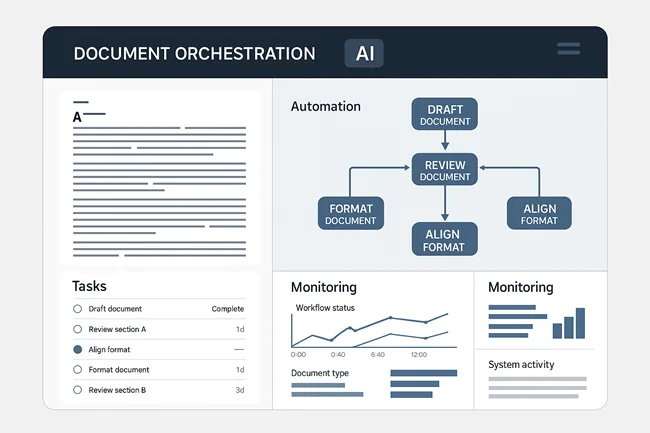

Cortex is not a generic large language model or off-the-shelf AI platform. Instead, it functions as a life sciences-specialist orchestration engine, engineered to embed domain knowledge, compliance context, and structured traceability into every layer of process automation. According to Indegene, Cortex underpins solutions like NEXT Medical Writing Automation by managing multi-step workflows—such as drafting, reviewing, formatting, and aligning documents to sponsor-specific formats—all while maintaining auditability and integration with Regulatory Information Management (RIM) systems.

This separation from horizontal GenAI platforms positions Cortex closer to enterprise-grade systems like Veeva Vault or IQVIA’s Orchestrated Clinical Trials suite, but with a nimble, modular deployment style. Cortex integrates not only with Microsoft Word and common document environments but also with pharma-grade information systems—allowing regulated entities to maintain chain-of-custody, change control, and compliance logs across AI-powered workflows.

As healthcare and biopharma firms increasingly seek AI that works inside the boundaries of regulation rather than outside of them, Cortex gives Indegene a strong narrative for winning long-cycle contracts in medical affairs, pharmacovigilance, and regulatory documentation.

Industry experts suggest that the real monetization upside from Cortex lies not just in cost savings but in risk mitigation and throughput scaling, two elements that global sponsors prize in clinical development operations. With timelines tightening and global trial complexity rising, automation engines that provide traceability across multi-stakeholder, multilingual documentation are poised to see greater institutional adoption.

While Indegene has not disclosed the direct revenue contribution from Cortex-driven platforms, analysts expect higher attach rates for AI-based offerings like NEXT across existing U.S. and EU biopharma clients. The key is how deeply these platforms are embedded within regulated workflows—where switching costs, once implemented, are typically high.

Institutional sentiment following the NEXT launch remains cautiously optimistic. Shares of Indegene closed lower on July 11, 2025, at ₹563.00, reflecting a typical short-term reaction to product announcements without financial uplift. However, institutional investors appear more focused on whether Cortex can scale across multiple verticals, including not only medical writing but also real-world evidence synthesis, regulatory labeling, and digital engagement analytics.

Indegene’s vertical AI play with Cortex may also set the stage for platform-led margin expansion, especially in light of growing global demand for compliance-native GenAI applications. As major healthcare SaaS players chase volume, Indegene’s strategy of depth over breadth could attract higher-margin, high-trust clientele.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.