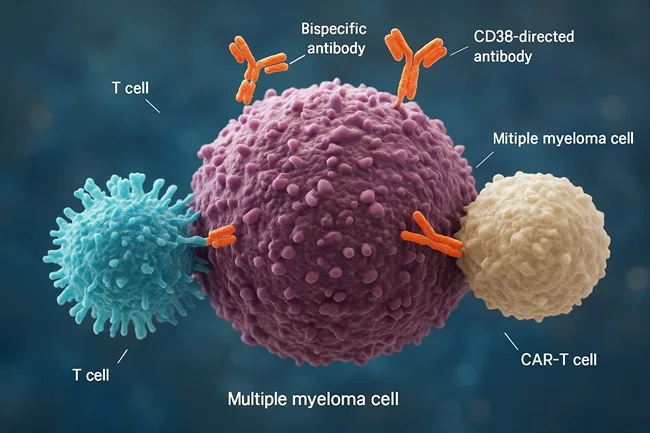

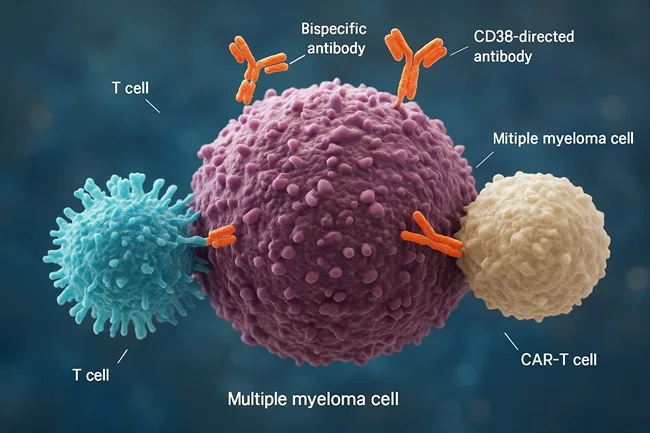

Multiple myeloma, a cancer of plasma cells, has been transformed in the past decade by the arrival of advanced immunotherapies. Chimeric antigen receptor T-cell therapies (CAR-T), bispecific antibodies, and CD38-directed monoclonal antibodies have all shifted survival curves and offered new hope to patients who once faced limited options. Now, with the emergence of immune-based doublets such as Johnson & Johnson’s TECVAYLI® (teclistamab-cqyv) combined with DARZALEX FASPRO® (daratumumab and hyaluronidase-fihj), the oncology community is asking whether these approaches can move from salvage settings into earlier lines of therapy, potentially even frontline treatment for transplant-eligible patients.

What is the current balance between CAR-T and bispecifics in multiple myeloma?

CAR-T therapies such as idecabtagene vicleucel, marketed as Abecma, and ciltacabtagene autoleucel, known as Carvykti, have delivered impressive outcomes in relapsed or refractory multiple myeloma. They harness a patient’s own T-cells, engineer them to recognize BCMA antigens on myeloma cells, and then reinfuse them to mount an aggressive immune response. Response rates in heavily pretreated patients have been among the highest ever seen in myeloma, but the therapy comes with significant hurdles. Manufacturing takes time, facilities are limited, and risks such as cytokine release syndrome and immune effector cell-associated neurotoxicity syndrome require specialized care.

Bispecific antibodies, in contrast, offer an off-the-shelf approach. By simultaneously binding to the CD3 receptor on T-cells and to tumor antigens such as BCMA, they redirect immune cells to target cancer. These agents avoid the long manufacturing timelines associated with CAR-T and are easier to deliver at scale. However, durability of response has often been lower than CAR-T, with many patients experiencing eventual relapse. A comparative analysis of published data found that complete response rates in relapsed or refractory settings reached over 50 percent with CAR-T, compared to about one-third with bispecific antibodies. That said, bispecifics tend to have a more manageable safety profile and are readily accessible, factors that could prove decisive as trials move them into earlier disease settings.

How are immune-based doublets being positioned for newly diagnosed patients?

The most striking evidence so far comes from Johnson & Johnson’s MajesTEC-5 Phase 2 trial. In transplant-eligible newly diagnosed multiple myeloma patients, combinations of TECVAYLI and DARZALEX FASPRO with lenalidomide, with or without bortezomib, produced deep responses rarely seen in this setting. All evaluable patients achieved minimal residual disease negativity after treatment cycles, with next-generation flow confirming results at a sensitivity of 10⁻⁵ and sequencing demonstrating negativity at 10⁻⁶. Nearly 86 percent of patients achieved a complete response or better after six cycles, while stem cell mobilization was successful in over 95 percent of participants.

The concept is simple but powerful. Instead of saving bispecific antibodies or T-cell engagers for patients who have exhausted standard regimens, the strategy is to deploy them earlier when the immune system is healthier and more responsive. Physicians involved in the study described the synergy between TECVAYLI and DARZALEX FASPRO as a way to reduce cancer burden rapidly, while sparing patients the long-term toxicities of steroid-heavy regimens. This approach could mark the start of a shift from chemotherapy-intensive induction to immune-centric induction in frontline care.

What challenges stand in the way of moving CAR-T and bispecifics earlier in the treatment journey?

There are several barriers to adoption. The first is safety. CAR-T has a higher incidence of severe cytokine release syndrome and prolonged cytopenias, making it risky for use in otherwise healthier newly diagnosed patients. While bispecifics and immune doublets show a more favorable safety profile, they still produce immune-related toxicities that require monitoring. The second challenge is infrastructure. CAR-T requires advanced manufacturing facilities, long preparation times, and specialist centers to manage complications. Even bispecifics, though easier to distribute, demand close monitoring in the initial treatment phases.

Cost is another formidable barrier. These therapies are among the most expensive in oncology, and payers will demand evidence that they produce durable benefits when moved into larger patient populations. This ties into the fourth challenge: sequencing. Using CAR-T or bispecifics early raises questions about what treatments remain effective at relapse. Early use might limit future options if antigen escape or immune exhaustion sets in. Finally, regulatory expectations are higher for frontline therapies, requiring longer follow-up and head-to-head comparisons with established standards.

Are there early signals that immune-based doublets could succeed in earlier lines?

Despite these challenges, the momentum is clear. The MajesTEC-5 data show unprecedented depth of response in newly diagnosed patients. Bispecific antibodies are being tested in earlier settings across multiple global trials. Regulatory approvals are already moving CAR-T earlier, with ciltacabtagene autoleucel approved in some cases after just one prior line of therapy and idecabtagene vicleucel after two prior lines. These milestones indicate that the regulatory environment is shifting to accommodate earlier immune therapy use.

Clinicians have also pointed out that T-cell function is stronger in patients with less prior treatment exposure. By intervening earlier, therapies such as CAR-T and bispecifics may deliver more durable benefit. Expert working groups have begun to argue that the time to harness the immune system is before it has been worn down by repeated chemotherapy, not after. The idea of using immune doublets upfront is gaining credibility, especially as trial data increasingly point toward long-term benefit without compromising subsequent transplant eligibility.

What steps are needed for immune-based doublets to become standard of care?

To achieve adoption as standard therapy, several conditions must be met. Randomized Phase 3 trials comparing immune-based doublets against existing first-line regimens are essential. These trials will need to demonstrate not only higher response rates but also improvements in progression-free survival, overall survival, and quality of life. Cost effectiveness will be central to payer acceptance, with outcome-based reimbursement models likely to emerge. Infrastructure must scale to ensure that therapies are not limited to elite centers, while real-world safety monitoring must capture long-term risks.

Patient stratification will also be critical. High-risk patients with poor cytogenetics may benefit the most from early immune therapy, while lower-risk patients might still do well with conventional regimens. Clinical guidelines will need to incorporate biomarkers and patient characteristics to guide decision-making.

What does this mean for the multiple myeloma sector and the broader market?

The implications are profound. If immune-based doublets move into earlier lines, frontline therapy for transplant-eligible patients could shift dramatically away from steroid-heavy and chemotherapy-based regimens. This would improve patient quality of life and potentially extend relapse-free survival. For pharmaceutical companies, the commercial stakes are significant. Earlier-line adoption means larger patient populations and higher revenue potential. Johnson & Johnson, with both TECVAYLI and DARZALEX FASPRO, is strategically positioned, but competitors such as Bristol Myers Squibb with Abecma, and GSK with Blenrep, are racing to capture market share.

From an investor perspective, sentiment around Johnson & Johnson (NYSE: JNJ) has been steady, reflecting the strength of its diversified portfolio. Oncology is a growth driver for its Innovative Medicine division, which delivered over $60 billion in revenue last year. Analysts note that trial successes like MajesTEC-5 reinforce J&J’s leadership in hematology. Institutional flows into JNJ stock have remained positive, reflecting confidence in its dividend-yielding stability with oncology pipeline upside. Investors are watching carefully for Phase 3 data that could transform the frontline multiple myeloma market.

The sector outlook suggests rising competition, with multiple companies vying to secure earlier approvals. Health systems and regulators will have to navigate cost pressures while ensuring equitable patient access. For patients, the promise of deeper and longer-lasting remission earlier in the disease trajectory is a compelling reason to support these innovations.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.