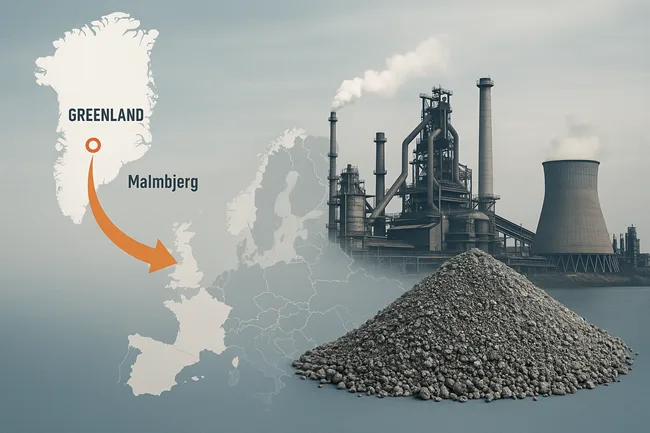

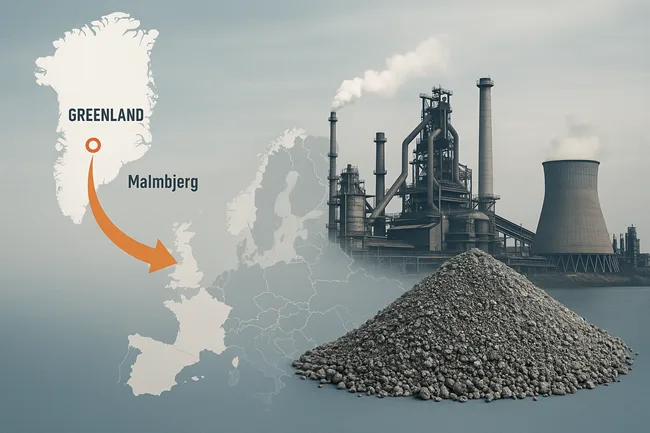

Europe’s long-term industrial backbone may be cracking under the weight of a critical dependency: its reliance on China for molybdenum. This little-known but indispensable alloying metal is essential for defense, specialty steel, and clean energy technologies. With no domestic extraction and rising geopolitical volatility, the European Union has been left exposed. Now, a single Arctic project may help reset the balance.

Greenland Resources Inc., a Canadian public company listed on the NEO Exchange (NEO: MOLY), is advancing the Malmbjerg molybdenum project in eastern Greenland—an asset that could supply up to 25% of the EU’s annual demand and meet 100% of its defense requirements. Armed with a new 30-year exploitation license and backed by the European Raw Materials Alliance (ERMA), the project is being positioned as one of the continent’s most strategically aligned critical minerals developments.

With molybdenum increasingly targeted by Chinese export controls and defense spending across Europe soaring, the Malmbjerg project has captured the attention of industrial planners and institutional investors alike.

How exposed is Europe to Chinese molybdenum supply disruptions, and why is this metal so critical?

The European Union is the world’s second-largest consumer of molybdenum, accounting for roughly 122 million pounds per year, or about 19% of global demand. Yet, despite its sophisticated downstream capabilities in specialty steel and green infrastructure, Europe has no domestic molybdenum mining and depends almost entirely on imports.

China dominates the global supply of primary molybdenum, producing around 87% of total output, while the United States supplies the remaining 13%. China’s grip on the market has tightened in recent years with the introduction of export restrictions, prompting concerns over availability and price volatility. To complicate matters, China has recently become a net importer of molybdenum, adding pressure to an already constrained market.

Molybdenum is not just an industrial metal—it’s a strategic one. More than 80% of carbon and stainless steels used in defense applications require molybdenum alloying for strength, corrosion resistance, and performance at high temperatures. In addition, molybdenum is used in green technologies including wind turbines, solar panels, hydrogen systems, and desalination plants.

With Germany, Italy, and Finland among the EU’s top consumers, any disruption in global supply has a cascading effect on both Europe’s economic competitiveness and defense readiness.

Why is the Malmbjerg project in Greenland considered a turning point for EU resource independence?

Greenland’s Malmbjerg project is a rare example of a shovel-ready, high-grade molybdenum deposit located within an EU-associated territory. Greenland Resources, the Canadian firm behind the development, recently secured a 30-year exploitation license from the Greenlandic government, paving the way for long-term production and export.

The Malmbjerg deposit hosts Proven and Probable Reserves of 245 million tonnes grading 0.176% MoS₂, containing approximately 571 million pounds of molybdenum. Importantly, the first decade of mining is expected to focus on higher-grade zones, enabling average annual production of 32.8 million pounds—about one-quarter of the EU’s total demand.

Strategically, the project is supported by ERMA, the European Union’s flagship raw materials body tasked with reducing reliance on foreign suppliers for critical minerals. As Greenland is considered an EU Associate country, the project benefits from streamlined collaboration under the bloc’s Critical Raw Materials Act, which aims to ensure that at least 10% of critical minerals are sourced domestically by 2030.

Malmbjerg’s location in eastern Greenland allows direct maritime access to Europe, reducing transportation distances and carbon intensity compared to Chinese or South American sources.

What is the commercial and financial viability of Greenland Resources’ molybdenum project?

The economics behind Malmbjerg are robust. The project is backed by a 2022 NI 43-101 Definitive Feasibility Study prepared by Tetra Tech, which outlines a capital expenditure of US$820 million, a levered after-tax internal rate of return (IRR) of 33.8%, and a payback period of just 2.4 years—assuming a molybdenum price of US$18 per pound.

The mine has been designed with ESG performance in mind. As an open-pit operation, it utilizes modular infrastructure to reduce land impact, employs saline water to minimize freshwater usage, and limits aquatic disturbance. The low deleterious element profile of the ore also reduces the need for intensive processing, improving its environmental footprint.

In addition to molybdenum, the company is exploring the potential to recover magnesium from saline water and concentrate—a market also dominated by China. Greenland Resources has indicated that magnesium could be incorporated into the project’s economic model as an additional strategic byproduct.

How does the recent MOU with Hempel Metallurgical GmbH strengthen market credibility?

In September 2025, Greenland Resources signed a memorandum of understanding (MOU) with Düsseldorf-based Hempel Metallurgical GmbH for the long-term supply of molybdenum. Hempel is a leading molybdenum distributor to the German steel industry and part of the broader Hempel Group, which has decades of experience in specialty metal trading.

The MOU outlines the future supply of both Molybdenite concentrate and secondary products like Ferromolybdenum and Molybdenum Oxide. Roasting will take place in Belgium, leveraging Europe’s existing processing infrastructure.

This agreement is not just a commercial milestone—it validates Malmbjerg’s role in supporting Europe’s steel and industrial base. With Germany expected to increase defense spending from 1.5% to around 5% of GDP, demand for secure alloying metals is expected to surge. Greenland Resources is also reportedly in advanced discussions with other EU steelmakers in Italy and Finland for similar offtake deals.

What does the future look like for Europe’s strategic mineral supply strategy beyond molybdenum?

The Greenland–Hempel deal is part of a broader shift in European mineral sourcing. As the continent transitions toward clean energy, digital infrastructure, and enhanced defense, supply chain sovereignty has moved to the forefront of policy and capital markets.

In March 2024, the EU passed the Critical Raw Materials Act, committing to more self-reliant supply chains. Key goals include extracting at least 10% of strategic minerals within the EU or associate countries, processing 40% domestically, and sourcing 25% from recycled materials by 2030. Molybdenum has since been listed as a strategic raw material due to its dual-use applicability in both civilian and military sectors.

Greenland Resources’ progress—alongside other Arctic-focused projects like Tanbreez (rare earths) and Bluejay Mining (titanium/zinc)—demonstrates the EU’s increasing interest in Greenland as a long-term partner in mineral security. Unlike traditional jurisdictions, Greenland offers a geostrategic location, favorable regulatory framework, and direct maritime access to European ports.

What are analysts and institutional investors watching for next?

Investor sentiment toward Greenland Resources has grown more optimistic in recent months, particularly following the award of the exploitation license and the signing of the Hempel MOU. Analysts are now watching for three key developments: (1) the finalization of offtake agreements with major EU steelmakers, (2) project-level financing or strategic equity investment, and (3) updates on magnesium recovery feasibility.

The Malmbjerg project must commence mining activities before the end of 2028 as per licensing conditions. With feasibility economics already established, institutional appetite is expected to increase as market pricing for molybdenum tightens and EU policy support accelerates.

If Greenland Resources successfully reaches final investment decision and begins construction, it could become one of Europe’s most critical contributors to supply chain resilience, green energy development, and defense material sovereignty.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.