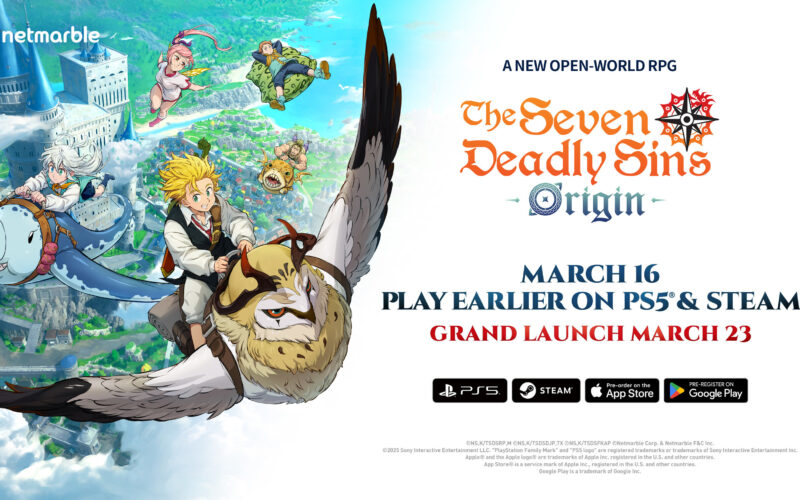

Netmarble Corporation confirmed the global launch schedule for its open-world role-playing game The Seven Deadly Sins: Origin, with early access beginning March 16, 2026 on PlayStation 5 and Steam, followed by a full multi-platform launch including mobile devices on March 23. The announcement signals a controlled platform-first deployment strategy aimed at technical stability, franchise longevity, and cross-platform monetisation rather than a single-day mass release.

The decision matters because The Seven Deadly Sins: Origin represents one of Netmarble Corporation’s most ambitious attempts to translate a high-value Japanese manga and anime intellectual property into a scalable open-world gaming ecosystem spanning console, PC, and mobile audiences. The staggered launch provides early performance validation on higher-end platforms before exposing the title to the far larger and more fragmented mobile user base.

Why is Netmarble prioritising a console and PC-first rollout before expanding The Seven Deadly Sins: Origin to mobile players?

Netmarble Corporation’s choice to open early access on PlayStation 5 and Steam before the mobile launch reflects a strategic recalibration that has become increasingly common among publishers attempting to balance technical credibility with monetisation scale. Console and PC platforms offer more predictable hardware performance, lower fragmentation, and clearer telemetry during early live-service tuning.

For an open-world role-playing game, stability at launch has become a material determinant of long-term engagement. Recent industry history shows that performance issues during the first weeks of release can permanently damage player trust, community sentiment, and review aggregation, particularly for intellectual property-driven titles where expectations are already elevated. By staging the rollout, Netmarble Corporation reduces the risk of early systemic failures cascading across platforms simultaneously.

From an operational perspective, the approach allows Netmarble Corporation to validate combat pacing, traversal systems, and user interface responsiveness under real-world load conditions before scaling globally on mobile, where latency tolerance is lower and churn risk is higher. This is less about exclusivity and more about risk containment.

How does The Seven Deadly Sins: Origin fit into Netmarble Corporation’s broader franchise and platform strategy?

The Seven Deadly Sins intellectual property has already proven its commercial viability through earlier titles such as The Seven Deadly Sins: Grand Cross, which established a durable mobile player base and recurring revenue profile. The Seven Deadly Sins: Origin is structurally different. It is positioned as an open-world role-playing experience rather than a menu-driven or gacha-centric mobile-first design.

This shift signals Netmarble Corporation’s intent to push the franchise beyond episodic monetisation into longer-session gameplay formats that are more aligned with console and PC norms. That matters strategically because it expands the lifetime value curve of the intellectual property and creates room for post-launch expansions, seasonal content, and cross-platform progression models.

In effect, The Seven Deadly Sins: Origin is being treated less as a single product launch and more as a platform entry within Netmarble Corporation’s portfolio. The open-world structure allows the company to support narrative extensions, character introductions, and cooperative gameplay modes over multiple years without rebooting the core engine.

What does the emphasis on closed beta feedback reveal about execution risk and development priorities?

Netmarble Corporation indicated that changes implemented ahead of launch are based on closed beta test feedback, with specific attention to controls, combat pacing, and user interface and user experience design. That focus is instructive. These are not cosmetic refinements but core interaction layers that directly influence session length and player retention.

Combat pacing in particular has become a differentiator in anime-derived role-playing games, where players expect mechanical depth without excessive grind. Adjustments at this stage suggest that Netmarble Corporation is actively tuning the balance between accessibility and mastery, especially important when transitioning from mobile-centric audiences to console players accustomed to tighter feedback loops.

User interface clarity also becomes critical in cross-platform games. A system that works on a large screen with a controller does not automatically translate to touch-based mobile interaction. Addressing these issues before full mobile exposure reduces the probability of divergent player experiences that could fragment the community.

Why is cross-platform expansion critical to the commercial thesis behind The Seven Deadly Sins: Origin?

The commercial ceiling for premium console role-playing games is materially lower than for successful mobile titles, even when intellectual property recognition is strong. Netmarble Corporation’s long-term revenue thesis therefore depends on mobile expansion, not as an afterthought but as the primary scaling mechanism.

By launching mobile on March 23 rather than day one, Netmarble Corporation gains the benefit of early player advocacy and content validation from console and PC users. Positive early sentiment can materially improve mobile acquisition efficiency, particularly in organic discovery channels and social platforms.

Cross-platform availability also enables Netmarble Corporation to unify its community across devices, supporting party-based exploration and cooperative play without forcing players into platform-specific silos. That approach increases engagement density and supports live-service economics over time.

How does the Seven Deadly Sins intellectual property influence launch expectations and risk exposure?

The Seven Deadly Sins manga has sold more than 55 million copies globally, giving the franchise unusually strong baseline awareness for a role-playing game launch. That recognition lowers initial marketing friction but raises execution risk. Franchise-based games are judged more harshly when they fail to capture the tone, character dynamics, or world-building depth of their source material.

Netmarble Corporation’s emphasis on voice actor interview content ahead of launch indicates a deliberate effort to reinforce authenticity and emotional continuity with the anime adaptation. This is not incidental promotion. It is a signal to core fans that the game is being positioned as a canonical extension of the universe rather than a derivative spin-off.

That strategy can pay dividends if the game successfully integrates narrative progression with open-world exploration. If it fails, franchise backlash tends to be louder and more persistent than for original intellectual property.

What are the competitive implications for anime-based open-world games?

The anime-derived game market has become increasingly crowded, but most titles remain constrained by mobile-first design limitations. Fully realised open-world implementations remain relatively rare due to development cost, engine complexity, and long production cycles.

By committing to a multi-platform open-world architecture, Netmarble Corporation is implicitly positioning itself against a narrower but more ambitious peer group. This raises expectations around environmental scale, character interaction systems, and live-service cadence.

If The Seven Deadly Sins: Origin succeeds, it could pressure competitors to rethink their reliance on lightweight adaptations and invest in deeper gameplay systems. If it struggles, it will reinforce the industry bias toward simpler, monetisation-first designs tied closely to mobile platforms.

How should investors and industry observers interpret this launch strategy?

Netmarble Corporation is not a publicly traded pure-play console publisher. Its financial performance has historically been driven by mobile revenue streams. This launch therefore should not be interpreted as a pivot away from mobile, but rather as an attempt to de-risk mobile scaling through upfront quality control.

From an investor sentiment perspective, the measured rollout suggests capital discipline rather than overreach. The company is not chasing day-one volume at the expense of long-term retention metrics. That aligns with a broader industry trend where publishers are increasingly judged on engagement durability rather than initial download spikes.

Execution remains the key variable. The complexity of synchronising console, PC, and mobile development pipelines introduces operational risk. However, the staged timeline suggests Netmarble Corporation is prioritising control over speed.

What happens next if the rollout succeeds or underperforms?

If early access on PlayStation 5 and Steam demonstrates stable performance and positive engagement metrics, Netmarble Corporation will enter the mobile launch window with strengthened confidence and potentially lower user acquisition costs. That scenario supports a multi-year content roadmap and reinforces the franchise’s role within the company’s portfolio.

If performance issues or gameplay criticisms emerge during early access, the company retains a narrow but meaningful window to adjust before mobile exposure. That flexibility is the central advantage of the staged rollout.

Failure at both stages would likely confine The Seven Deadly Sins: Origin to a niche audience and limit its revenue contribution. Given the scale of the intellectual property, that outcome would represent a strategic setback rather than an existential threat.

Key takeaways: What Netmarble Corporation’s launch strategy signals for franchise gaming, cross-platform execution, and live-service economics

- Netmarble Corporation is prioritising technical stability and gameplay validation over maximum day-one reach.

- A console and PC-first rollout reduces execution risk before exposing the game to mobile scale.

- The Seven Deadly Sins: Origin is positioned as a long-term platform, not a one-off title.

- Closed beta-driven refinements indicate focus on retention-critical systems rather than surface polish.

- Mobile expansion remains the core monetisation engine, but is being deliberately de-risked.

- Franchise authenticity is being actively reinforced through voice actor and narrative alignment.

- Success could raise competitive pressure on other anime-based game developers.

- Failure would limit upside but is partially mitigated by the staged deployment approach.

- The strategy reflects growing industry emphasis on durability over launch theatrics.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.