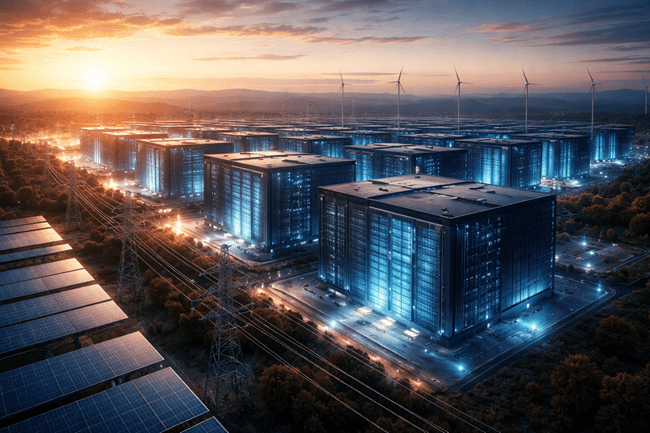

SB Energy, a subsidiary of SoftBank Group, has secured a combined $1 billion equity investment from OpenAI and SoftBank to accelerate the buildout of advanced AI-focused data center campuses. The move includes OpenAI’s formal lease of 1.2 gigawatts of capacity at SB Energy’s Milam County site in Texas and marks a new phase of execution for the $500 billion Stargate initiative unveiled at the White House in early 2026.

With this funding, SB Energy will build and operate purpose-designed AI infrastructure for OpenAI while expanding its footprint as a vertically integrated platform developer across energy and compute infrastructure. OpenAI will also become a customer of SB Energy’s internal tech stack, including ChatGPT deployments and API integrations.

Why is OpenAI partnering with SB Energy—and why does SoftBank’s dual role as investor and sponsor matter?

This transaction is not just about capital—it is a tightly choreographed alignment of engineering control, operational speed, and financial scalability. OpenAI, under pressure to find power-dense, latency-optimized capacity for its expanding compute workloads, is effectively doubling down on first-party infrastructure with trusted developers. Rather than rely solely on hyperscaler leases, OpenAI is working with SB Energy to execute bespoke builds that reflect its own architectural priorities, from thermal envelope design to AI chip rack density.

SoftBank Group’s role is equally critical. As both a financial investor and longtime parent of SB Energy, SoftBank is using this vehicle to reinsert itself into the AI infrastructure value chain. The $500 million commitment alongside OpenAI represents more than passive capital—it signals a renewed willingness to underwrite full-stack energy-data convergence bets. Given SoftBank Group’s historical tech investing posture, its capital here acts more like acceleration fuel than neutral financing.

SB Energy’s development model also gives OpenAI something hyperscalers cannot: control. With Studio 151 now in-house—an acquisition disclosed alongside the investment—SB Energy controls procurement, engineering, and construction across all its planned campuses. That compresses time-to-deployment and may allow OpenAI to scale its Stargate ambitions without facing the same gridlock seen at other cloud builds.

How does the 1.2 GW Milam County lease fit into broader U.S. AI data center geopolitics?

The 1.2 GW lease in Milam County, Texas, is not just another data center announcement—it is a geopolitical data point. As the United States pushes for energy-sovereign, low-latency compute infrastructure that can support AI model training and inference without relying on overseas supply chains, large AI-native campuses like this one are being closely watched by both regulators and allies.

Milam County offers strategic advantages: grid flexibility, available land, and fewer permitting bottlenecks compared to coastal metros. SB Energy’s commitment to build new generation alongside the data center to “protect Texas ratepayers” signals a distributed energy alignment model, likely involving on-site renewables or co-located energy storage. The company’s water-efficient cooling design is another nod to regional sensitivities, especially as Texas faces drought risks and rising scrutiny over hyperscale water use.

From a national infrastructure lens, Stargate is being positioned as an “AI moonshot,” with the White House citing it as a cornerstone of digital sovereignty. That context elevates this project beyond a commercial lease—it places it within the strategic narrative of AI industrial policy.

What does the Studio 151 acquisition signal about SB Energy’s operational ambition?

SB Energy’s acquisition of Studio 151, a data center construction and operations firm with experience across 20 campuses, strengthens its vertical integration. This brings engineering and execution certainty into its control stack—something crucial when racing against both time and capacity scarcity.

The move mimics the playbooks of cloud majors who bring construction engineering teams in-house to shorten project cycles and reduce handoff frictions. But SB Energy is positioning this differently—it is not just about being faster, but about delivering AI-specific infrastructure with repeatability.

Over the past 18 months, Studio 151 had reportedly been working with SB Energy and OpenAI on multiple projects. This pre-acquisition engagement track hints at a quasi-internal vendor model that was formalized through M&A. Now, SB Energy can iterate its data center design and build pipeline with greater control over materials, labor, and sequencing.

This is especially relevant for AI infrastructure, where traditional data center specs do not fit the thermal and electrical demands of AI clusters. Studio 151’s integration could be the execution backbone that allows SB Energy to offer “repeatable campuses at scale,” as stated by co-CEO Abhijeet Sathe.

How does this transaction align with SB Energy’s funding history and expansion posture?

The $1 billion equity infusion follows an earlier $800 million redeemable preferred equity investment from Ares Infrastructure Opportunities funds in 2025, marking the third Ares financing for SB Energy since 2020. This continuity in funding sources reflects a consistent capital stack strategy built around strategic equity rather than debt-heavy expansion.

SB Energy has transitioned from being a utility-scale solar player to a full-stack infrastructure platform combining energy, data, and construction. Its integrated model spans project development, supply chain management, financing, power marketing, and now, AI-specific data center builds. The current pipeline includes several multi-gigawatt campuses slated to enter service starting in 2026.

As demand for AI compute continues to outstrip traditional cloud expansion timelines, companies like SB Energy are emerging as credible build-to-spec partners that bridge the gap between vision and watts-on-the-ground execution.

The latest investment also positions SB Energy as a preferred partner for other hyperscalers or AI startups looking to avoid congestion in traditional colocation hubs. With the non-exclusive nature of the partnership, the company is free to replicate this model with other AI compute customers—possibly even in international markets.

What execution risks or scaling challenges remain despite the capital and partnerships?

While the funding and partnerships are robust, there are clear operational risks ahead. Building 1.2 gigawatts of data center capacity is a logistical and engineering feat—especially when combined with new energy generation and community workforce development.

Texas, despite its deregulated energy market advantages, also presents infrastructure risks. Grid volatility, policy uncertainty around renewable buildout timelines, and water usage constraints could challenge deployment targets.

Additionally, scaling beyond Milam County will test SB Energy’s ability to deliver simultaneously across multiple campuses without fragmenting its supply chain or overextending its workforce. The acquisition of Studio 151 helps mitigate some of these risks, but scaling execution will require careful staging and consistent throughput.

From OpenAI’s perspective, the dependence on a single partner for such a large build raises concentration risk, even with non-exclusive safeguards. However, the partnership’s structure appears designed to allow modular, repeatable replication—a potential hedge against execution drag.

How are investors and hyperscaler competitors likely to interpret this development?

For investors, the deal underscores a growing bifurcation in AI infrastructure strategy. Instead of relying on traditional hyperscaler leasing models, OpenAI is crafting vertically integrated, first-party deployments with strategic partners. This may prompt other AI firms or LLM platform players to pursue similar arrangements—particularly if hyperscaler supply remains constrained.

Hyperscaler competitors may see SB Energy’s positioning as a niche threat in the ultra-high-density AI data center segment. Unlike Amazon Web Services or Microsoft Azure, which must generalize for multi-tenant use, SB Energy can optimize its campuses for singular AI workloads. That could mean higher utilization and lower costs per inference in key Stargate deployments.

SoftBank Group, long seen as pivoting away from capital-intensive plays, is signaling a return to infrastructure ownership—but with a twist. This time, it is doing so at the intersection of AI, energy, and geopolitical relevance, which may appeal to institutional allocators looking for next-gen infrastructure exposure.

Key takeaways: What does the SB Energy–OpenAI–SoftBank deal mean for AI data infrastructure in the U.S.?

- SB Energy has secured $1 billion in equity investment from OpenAI and SoftBank Group to build next-generation AI data centers, including a 1.2 GW campus in Texas.

- The deal marks a strategic execution phase for the $500 billion Stargate initiative and positions SB Energy as a vertically integrated build partner for AI-native infrastructure.

- OpenAI is shifting from hyperscaler leasing to controlled, first-party infrastructure design with trusted partners, signaling a broader trend in the AI infrastructure stack.

- The acquisition of Studio 151 enables SB Energy to compress build timelines by bringing engineering, procurement, and operations in-house.

- SoftBank Group’s capital re-entry highlights renewed interest in energy–compute convergence plays with geopolitical overtones.

- SB Energy’s non-exclusive agreement leaves the door open for additional AI platform customers seeking bespoke data center solutions.

- Execution risks include Texas grid volatility, workforce scalability, and build logistics across multiple gigawatt-scale sites.

- Investors may interpret this move as a signal that traditional cloud infrastructure models are being supplemented by purpose-built AI environments.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.