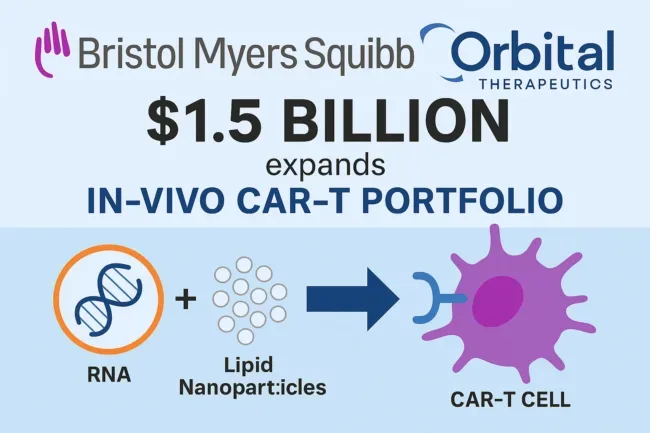

Bristol Myers Squibb Company (NYSE: BMY) has announced plans to acquire privately held Orbital Therapeutics in a cash transaction valued at $1.5 billion, a move designed to accelerate its transition from ex-vivo to in-vivo CAR-T therapies. The American drugmaker said the deal will bring it closer to developing cell therapies that can be delivered directly inside the body—potentially redefining how autoimmune and hematologic diseases are treated. The acquisition, subject to customary closing conditions and regulatory approval, grants BMS access to Orbital’s circular-RNA and lipid-nanoparticle (LNP) delivery technology, as well as its lead candidate OTX-201, an investigational CD19-targeted CAR-T asset approaching IND-enabling completion.

Why is Bristol Myers Squibb investing $1.5 billion in Orbital Therapeutics—and what makes in-vivo CAR-T such a breakthrough bet?

For years, Bristol Myers Squibb has been a key player in commercial CAR-T, marketing Abecma and Breyanzi for hematologic cancers. Yet those treatments rely on an ex-vivo model—extracting, engineering, and reinfusing a patient’s own T cells through a complex supply chain that limits scale and drives cost. Orbital’s technology seeks to change that dynamic through RNA-encoded reprogramming, where LNPs deliver a circular-RNA payload that turns immune cells into therapeutic CAR cells inside the patient.

In principle, this approach could shrink the time from vein-to-vein from weeks to days, remove dependence on specialized manufacturing, and unlock entirely new indications in autoimmune diseases where continuous immunosuppression is the norm. OTX-201, Orbital’s flagship candidate, encodes a CD19 CAR intended to selectively deplete pathogenic B cells—resetting immune balance rather than broadly suppressing it.

BMS executives described the acquisition as a strategic expansion of its cell-therapy franchise, broadening beyond oncology into autoimmune medicine. If successful, the company could transform CAR-T from a boutique cancer procedure into a repeatable, drug-like therapy that can be administered in hospitals worldwide.

How did the market react to BMY’s announcement—and what does the early stock sentiment signal about investor confidence?

Bristol Myers Squibb’s shares slipped roughly 1 percent following the announcement, trading near $44 as investors digested the upfront outlay for a pre-IND platform. Analysts noted that the muted reaction reflects cautious optimism: while the science is compelling, proof of concept remains untested in humans. For long-term holders, the deal adds strategic depth; for short-term traders, it introduces uncertainty about near-term earnings visibility.

Institutional desks flagged the transaction as “strategic but not transformative” in the short run, echoing the cautious tone that typically greets large-cap biotech M&A focused on early-stage assets. The market’s mixed tone also reflects broader sector headwinds—2025’s compressed valuation multiples, higher funding costs, and investor fatigue after a wave of high-premium biotech acquisitions.

FII and DII flow data show net-neutral sentiment toward BMY for the week, suggesting institutional investors are waiting for clarity on Orbital’s IND submission and BMS’s integration roadmap. For portfolio managers, this makes BMY a “hold to accumulate on weakness” candidate rather than an immediate buy.

Where does the Orbital deal fit into the global CAR-T arms race—and how are rivals repositioning in the autoimmune space?

The competitive backdrop explains why BMS acted now. The in-vivo CAR-T race has intensified since early 2024, when emerging players such as Arsenal Bio, Capstan Therapeutics, and Vector Bio began attracting Big Pharma partnerships. Each is chasing the same scientific holy grail: delivering CAR-T capability via RNA or DNA vectors directly into the patient’s immune system.

Orbital Therapeutics, headquartered in Cambridge, Massachusetts, had already distinguished itself with its circular-RNA platform that extends protein expression and improves tolerability over linear mRNA. Its combination of RNA design, AI-based optimization, and LNP targeting made it a natural target for large-cap consolidation. Industry observers noted that the $1.5 billion price tag reflects not just OTX-201’s potential but also the platform’s reusability across oncology, vaccines, and rare diseases.

By acquiring Orbital, BMS effectively leapfrogs some rivals by owning a plug-and-play RNA delivery stack instead of relying solely on partnerships. Analysts expect this will give the firm more flexibility in designing next-generation CAR-T candidates, with internal manufacturing and regulatory synergies from its existing cell-therapy network.

What scientific promise does OTX-201 hold—and can circular RNA and LNP delivery truly overcome today’s CAR-T bottlenecks?

At the heart of Orbital’s pipeline is OTX-201—a circular RNA construct encoding a CD19-specific CAR delivered through proprietary LNPs. The therapy is designed to transiently express the receptor in vivo, enabling controlled depletion of B cells without long-term genomic integration. In autoimmune contexts such as lupus or myasthenia gravis, that could mean restoring immune tolerance with fewer side effects.

Circular RNA, unlike linear mRNA, forms a closed loop that resists degradation and supports longer protein translation, while Orbital’s LNP system allows for tissue-specific targeting and dose tunability. This “drug-like” architecture could make administration simpler—potentially through intravenous infusion rather than bespoke cell manufacturing.

However, BMS and its scientists face critical unknowns. Delivering RNA safely to T cells in vivo remains challenging, and regulators will scrutinize off-target activity, cytokine profiles, and the durability of immune reprogramming. Early IND-enabling data must therefore demonstrate not only efficacy but also precise kinetic control to satisfy evolving FDA gene-therapy standards.

Is the Orbital buyout part of a broader BMS pivot as it manages life after Eliquis and Revlimid?

Yes—and that context is crucial. Bristol Myers Squibb is navigating the gradual erosion of its blockbuster revenues from Eliquis and Revlimid. The company has responded with a deliberate shift toward immunology, oncology, and RNA platforms, reflected in three major 2025 moves: its 2seventy bio acquisition to consolidate Abecma, a $1.5 billion BioNTech partnership for next-generation immunotherapies, and now the Orbital buyout.

Each deal extends a common thread—betting on modular, programmable science that can yield multiple assets over time. By unifying ex-vivo, in-vivo, and RNA-based capabilities, BMS hopes to rebuild long-term growth visibility and reinforce its reputation as a scientific integrator, not just a product marketer.

Analysts view this as a coherent if capital-intensive strategy. With BMS’s free cash flow topping $10 billion annually, the balance sheet can support such innovation bets without stressing leverage ratios. Still, execution discipline will determine whether these platform investments translate into pipeline velocity and commercial impact.

What are the key milestones investors should watch—and what could go wrong before 2027?

The next 24 months will test whether this deal matures from narrative to value. The first marker will be IND submission and acceptance for OTX-201. If the FDA greenlights a Phase 1 trial, BMS could enter human testing in 2026. Interim safety and pharmacodynamic readouts—showing controlled CAR expression and predictable B-cell depletion—would validate the premise of in-vivo reprogramming.

Conversely, delays in CMC readiness, delivery optimization, or regulatory feedback could push timelines beyond 2026, eroding market patience. Another risk is integration—retaining Orbital’s Cambridge scientific team and maintaining the culture of rapid iteration within a pharma giant’s bureaucracy. Pricing models for autoimmune CAR-T are also uncharted territory; insurers will demand cost-effectiveness proof against biologics like Rituxan or Cosentyx.

From a capital-markets lens, investors will also monitor BMY’s earnings per share trajectory—expected around $6.50 for FY 2025—and whether incremental R&D spend from Orbital’s integration dilutes near-term margins. Analysts project minimal impact to 2026 EPS, but future gains depend on how quickly the pipeline advances into revenue-generating phases.

What does expert sentiment suggest about the long-term outlook for in-vivo cell therapy?

Industry observers see the Orbital acquisition as a high-conviction science bet with asymmetric upside. If in-vivo CAR-T succeeds, BMS could pioneer a category where complex manufacturing yields to scalable medicine. Early enthusiasm from scientific circles, tempered by realism on clinical hurdles, paints a picture of guarded optimism.

Market strategists argue that the deal aligns with the shift toward programmable immunology, mirroring trends across Novartis, Roche, and Pfizer, all of which are exploring RNA-guided immune modulation. For investors with longer horizons, this is a play on BMS’s ability to industrialize science once viewed as bespoke. Should OTX-201 or successor assets reach mid-stage trials by 2027, valuation re-rating could follow swiftly.

The road ahead: Can Bristol Myers Squibb turn science into scalability?

If all goes to plan, by 2027 Bristol Myers Squibb could stand as the first global company to deliver a clinically validated, in-vivo CAR-T therapy. Success would mean not just new products but a new category—one capable of treating hundreds of thousands of autoimmune patients who today rely on chronic immunosuppressants. Failure, on the other hand, would relegate BMS’s $1.5 billion outlay to another bold but premature experiment in biotech innovation.

Either way, the transaction underscores how the battle for the future of cell therapy has moved from the factory to the bloodstream—and Bristol Myers Squibb has just bought a front-row seat.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.