A new era of metabolic medicine is colliding with an old problem in U.S. healthcare: unregulated drug supply chains. As demand for GLP-1 receptor agonists like semaglutide and tirzepatide reaches unprecedented highs—fueled by obesity, lifestyle use, and celebrity endorsements—the parallel rise of compounded weight-loss drugs is setting off alarms among regulators, physicians, and public health experts.

Much like the early days of opioid prescriptions, patients are turning to non-FDA-approved, compounded versions of blockbuster drugs to bypass high prices, shortages, or prescribing restrictions. And once again, the cracks in enforcement and supply chain visibility may be letting a public health crisis take root—this time, under the banner of weight loss.

Why are patients turning to compounded semaglutide and tirzepatide instead of FDA-approved versions?

Originally developed for type 2 diabetes management, GLP-1 drugs such as semaglutide (marketed as Ozempic and Wegovy) and tirzepatide (marketed as Mounjaro and Zepbound) are now in high demand for their dramatic weight-loss effects. But with monthly costs often exceeding USD 1,000 and persistent shortages, patients are increasingly turning to compounding pharmacies—which offer custom-mixed, unbranded versions of these drugs at a fraction of the price.

These compounded formulations are sometimes available for as little as USD 200–300 a month, often accessible through telehealth startups, med-spas, or social media-linked vendors. The speed and convenience of online ordering, coupled with a lack of insurance coverage for branded drugs, have made compounded GLP-1s an attractive alternative for many consumers.

But unlike FDA-approved medications, compounded drugs are not required to go through rigorous clinical trials or standardized manufacturing inspections. And while some compounding pharmacies maintain high standards, others operate with limited oversight—especially when sourcing active pharmaceutical ingredients (APIs) from foreign manufacturers.

What are the known safety risks of compounded GLP-1 weight-loss drugs?

The FDA and several state pharmacy boards have issued multiple warnings about compounded semaglutide and tirzepatide. These formulations can vary significantly in dosage strength, salt forms, sterility, and delivery systems. In some cases, patients have reported receiving non-equivalent salt forms—such as semaglutide sodium or semaglutide acetate—which are not evaluated or approved for safety and efficacy.

More alarmingly, adverse event reports are climbing. According to poison control data and FDA filings, there has been a dramatic surge—up to 1,500%—in emergency calls related to injectable weight-loss drug overdoses. Some patients, influenced by unverified online dosage protocols, have required hospitalization due to gastrointestinal distress, vomiting blood, or dangerously low blood sugar levels.

Social media testimonials—while often promotional—have also exposed a darker reality. One mother was hospitalized after injecting a compounded weight-loss product purchased online, following dosing guidance from an influencer. The experience, while anecdotal, echoes the early opioid crisis, where overprescription, misinformation, and unchecked access fueled widespread harm.

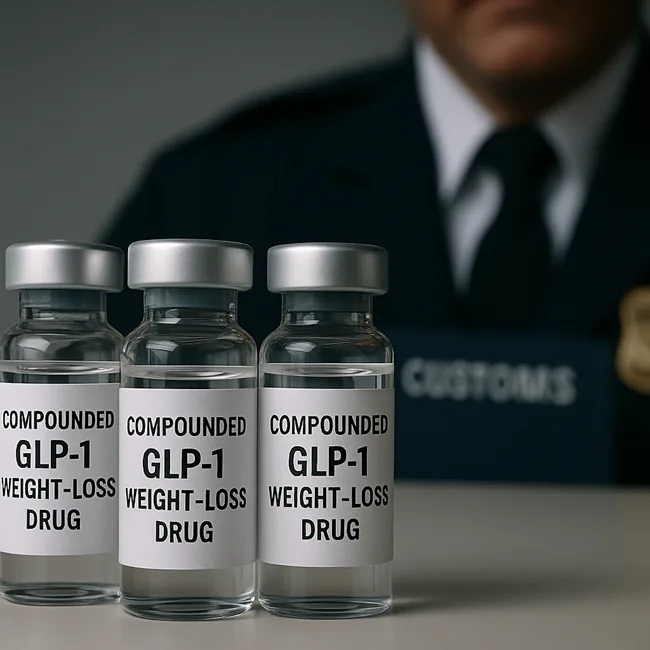

How is the FDA responding to the influx of illegal or non-compliant GLP-1 APIs?

On September 5, 2025, the U.S. Food and Drug Administration unveiled a new enforcement tool: the “green list” import alert for GLP-1 APIs. The list identifies foreign manufacturing sites that have passed FDA inspections or evaluations. APIs from these sources are allowed entry into the U.S., while shipments from all other sources will be detained without physical examination.

The move directly targets the compounding supply chain, particularly foreign-sourced raw materials that may not meet U.S. Current Good Manufacturing Practice (CGMP) standards. It marks a shift toward preemptive regulation at the border, instead of reactive recalls or post-market surveillance.

FDA Commissioner Dr. Marty Makary emphasized that the goal is to “protect consumers from poor-quality or dangerous GLP-1 drugs,” while Dr. George Tidmarsh, Director of the Center for Drug Evaluation and Research, called the targeting of illegal foreign ingredients “a critical part” of ensuring public safety.

Are state governments also tightening oversight of compounded GLP-1 drugs?

Yes, and the trend is accelerating. The Ohio Board of Pharmacy recently passed a rule limiting the sterile compounding of weight-loss drugs like Wegovy and Zepbound to just 250 doses in advance of any written prescriptions. The policy aims to prevent mass-production under the guise of patient-specific compounding—a gray area often exploited in high-demand categories.

Other states are reportedly reviewing their own compounding regulations, especially as compounded GLP-1s become a commercialized product rather than a personalized therapy. The concern is that some compounding pharmacies are functioning more like drug manufacturers, yet without the accountability or compliance requirements.

This evolving regulatory posture could significantly disrupt operations for large-scale compounding businesses that rely on foreign APIs and bulk batch production—particularly if they’re not listed on the FDA’s green list.

Why are analysts and healthcare experts drawing parallels with the opioid epidemic?

The opioid crisis escalated due to a combination of high patient demand, inadequate oversight, industry pushback, and unregulated alternatives. In that context, compounded GLP-1s present eerily similar dynamics.

In both cases, patients sought relief outside traditional pharmaceutical channels, often driven by cost constraints or limited access to approved treatments. Providers, in many instances, underestimated the associated risks or prioritized rapid business expansion over clinical caution. Meanwhile, enforcement mechanisms lagged behind market innovation, creating space for these unregulated alternatives to scale significantly before regulators stepped in.

Experts warn that if compounded semaglutide and tirzepatide remain widely accessible without strong checks, we could see a repeat of that trajectory—this time driven not by pain relief, but by weight loss, cosmetic goals, and unproven “longevity” claims.

Telehealth platforms have begun promoting microdosing regimens of GLP-1 drugs for general wellness and lifespan extension—claims not backed by clinical data and well outside approved indications. These practices not only exploit consumer insecurities but also further blur the lines between regulated medicine and commercialized health trends.

What is the outlook for compounded GLP-1 drugs in the U.S. market?

The regulatory squeeze is tightening. Between the FDA’s green list, state-level caps, and mounting lawsuits from Novo Nordisk and Eli Lilly, the window for legally and commercially viable compounding is narrowing.

At the same time, demand isn’t going anywhere. Millions of Americans remain priced out of branded GLP-1 drugs. Unless insurance coverage expands or generics enter the market, patients may continue to pursue compounded alternatives—regardless of safety warnings.

Pharma analysts suggest that we may be on the cusp of a bifurcated GLP-1 ecosystem: one with fully FDA-approved, high-cost branded drugs; and another, murkier world of online compounding, offshore APIs, and loosely monitored formulations.

Much like the opioid crisis, the risk isn’t just in the molecule—it’s in the systemic vulnerabilities that allow misuse, misinformation, and misaligned incentives to flourish unchecked.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.