With the sale of its diagnostics unit Coris Bioconcept SRL now complete, Avacta Group plc (AIM: AVCT) has made its boldest move yet toward becoming a next-generation oncology biotech. The UK-listed company is now singularly focused on its pre|CISION platform, which powers a pipeline of peptide drug conjugates (PDCs) designed to overcome the limitations of traditional antibody-drug conjugates (ADCs).

At the heart of Avacta’s strategy is a tumor-activated drug delivery approach that uses fibroblast activation protein (FAP) as a selective trigger. By confining payload activation to the tumor microenvironment, Avacta hopes to avoid the systemic toxicity and dosing challenges that have long limited the reach of ADCs.

The question now dominating institutional conversations: Can Avacta’s PDCs offer a clinically meaningful, commercially viable alternative to the ADC paradigm that has so far dominated targeted chemotherapy?

How do peptide drug conjugates differ from traditional ADCs in oncology drug delivery?

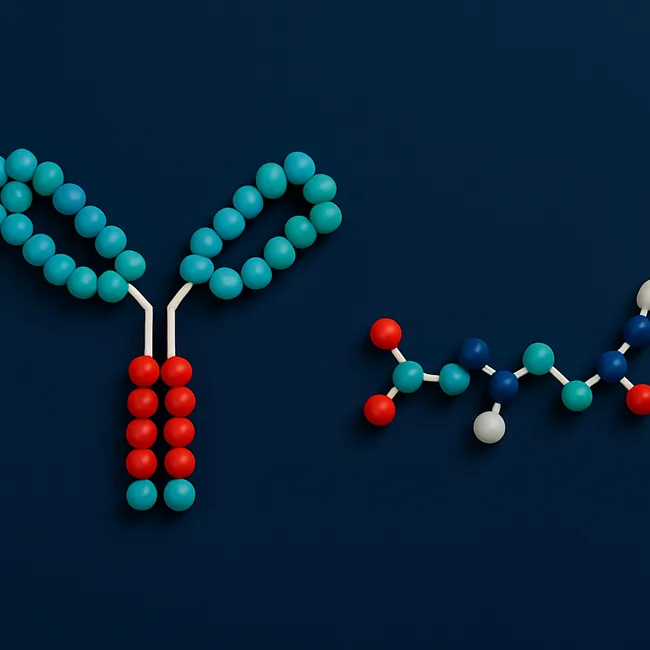

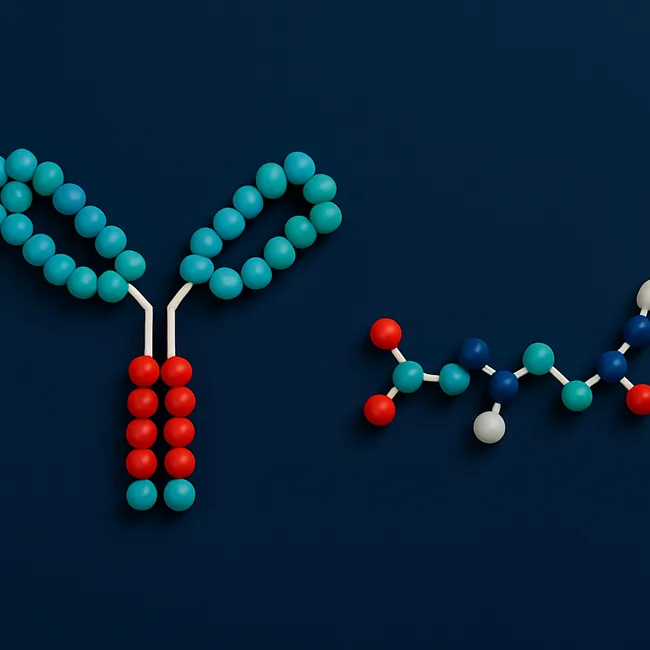

Both PDCs and ADCs are targeted drug delivery systems that aim to release cytotoxic agents selectively into tumors. But they differ significantly in structure, mechanism, and tumor interaction.

Traditional ADCs use a monoclonal antibody to target specific antigens on tumor cells. Once bound, the entire complex is internalized into the cell, where the linker is cleaved in the lysosome, releasing the cytotoxic drug. This approach has led to FDA approvals and billion-dollar sales for drugs such as Enhertu, Trodelvy, and Padcev.

By contrast, Avacta’s peptide drug conjugates use small, synthetic peptides instead of antibodies, and they rely on extracellular protease activity rather than internalization. Specifically, the pre|CISION platform uses a linker cleaved by FAP, a protease expressed in tumor-associated fibroblasts but largely absent in healthy tissues. This allows the payload to remain inert systemically and activate only within the tumor stroma.

The potential advantages are significant: better tissue penetration due to smaller molecule size, lower systemic toxicity due to FAP-selective activation, and potentially broader applicability across tumor types that lack targetable antigens.

Why is Avacta focusing on fibroblast activation protein and the tumor microenvironment?

FAP is gaining prominence as a non-cellular oncology target—an unusual but highly promising approach. Unlike HER2 or Trop-2, FAP is not found on tumor cells but in the fibroblastic stroma that surrounds them. This makes it a universal marker of the tumor microenvironment (TME), present in more than 90% of epithelial tumors including breast, colorectal, pancreatic, and lung cancers.

By using FAP as a biochemical trigger, Avacta is circumventing the limitations of cell surface antigen heterogeneity and resistance mutations that often render ADCs ineffective. The idea is that tumor-selective protease cleavage enables spatially controlled drug activation. This could reduce side effects like neutropenia and cardiotoxicity—common issues with ADCs—and allow for more aggressive dosing strategies.

The approach aligns with a broader industry trend: increasing interest in targeting the tumor microenvironment as a regulator of drug resistance and immune suppression.

What is the current status of Avacta’s clinical pipeline and lead assets?

Avacta’s lead program, AVA6000, is a FAP-activated doxorubicin conjugate that has shown encouraging results in early Phase I studies. According to company disclosures, AVA6000 has demonstrated a favorable safety profile with early signals of tumor-localized activity and reduced systemic exposure to free doxorubicin.

This is a significant development because doxorubicin’s utility has long been hampered by its dose-limiting cardiotoxicity. If Avacta’s PDC version allows for higher cumulative dosing without systemic toxicity, it could revive a potent drug for use in tumors traditionally deemed inoperable or chemoresistant.

Other pipeline assets include preclinical PDCs with novel payloads and early-stage Affimer drug conjugates (AffDCs) that combine Avacta’s proprietary protein scaffold with the same tumor-activated linker technology. These efforts aim to expand the platform’s utility across multiple payload classes and tumor indications.

While no PDC has yet reached Phase III, the company’s pipeline is being watched closely by institutional biotech investors and platform licensing scouts.

How does Avacta’s pre|CISION platform compare to market-approved ADC technologies?

Approved ADCs like Kadcyla and Enhertu use antibody targeting and lysosomal cleavage mechanisms. While successful in many cancers, they remain highly specific to tumor antigens like HER2 or Trop-2, which limits their utility in antigen-low or heterogenous tumors.

Avacta’s PDC approach could address several critical limitations associated with traditional ADCs. Unlike ADCs, which require internalization into cancer cells for payload activation, Avacta’s conjugates are designed to activate within the tumor stroma itself. This extracellular activation mechanism makes them potentially more effective in solid tumors that are difficult to penetrate or have poor vascularization.

Additionally, the smaller molecular size of peptide conjugates enables deeper and more uniform tumor penetration compared to bulky antibodies, granting access to tumor regions that ADCs often fail to reach. From a manufacturing perspective, peptides offer further advantages: they are synthetically produced, less structurally complex than biologics, and can be scaled with greater ease. This simplicity could translate into lower production costs and improved stability—key benefits for advancing combination therapies and broad clinical adoption.

Despite these advantages, PDCs still face challenges in achieving comparable half-life, target residence time, and regulatory validation that ADCs have already earned.

Are peptide drug conjugates attracting broader industry or partner interest?

PDCs remain an underexplored class, but that is beginning to change. Bicycle Therapeutics, another UK-based company, is advancing bicycle toxin conjugates that function similarly to PDCs and recently signed a $1.7 billion deal with Bayer. Ipsen has also entered the space via its collaboration with Aktis Oncology to develop FAP-targeted radiopharmaceuticals.

These moves suggest growing pharma appetite for FAP-activated payload delivery, especially in indications where ADCs have struggled or failed. The interest reflects a broader desire for tumor-agnostic targeting platforms that can deliver potent therapies with less toxicity and broader applicability.

If Avacta can show consistent, reproducible clinical data supporting its pre|CISION mechanism, it could find itself at the center of this emerging licensing market.

What are the investor risks and critical inflection points for Avacta?

Avacta’s pivot to oncology, while scientifically compelling, also heightens investor risk. As of its most recent update, the company’s cash runway extends into Q1 2026, offering a clear timeline for when new data or partnership revenue must materialize.

Key inflection points for Avacta include the upcoming Phase I/II expansion data for AVA6000, which could provide crucial validation of tumor-localized activation at higher therapeutic doses. Progress on advancing additional peptide drug conjugates into clinical development will also be closely watched, as it would demonstrate the broader applicability and scalability of the pre|CISION platform.

Institutional investors are expected to monitor signs of pharmaceutical interest, including potential partnerships, licensing deals, or collaborative research agreements that could further de-risk the program. Additionally, clarity around the development and utility of Affimer-based payloads may be pivotal, particularly for companies seeking alternatives to conventional antibody scaffolds in targeted oncology.

Any delay in these milestones could pressure the share price, especially with financing needs likely to re-emerge in 2026.

Could peptide drug conjugates redefine the future of targeted chemotherapy?

Peptide drug conjugates represent a new logic in oncology drug delivery—one that emphasizes conditional activation over fixed targeting. For patients, this could mean safer, more effective treatments. For drug developers, it opens new therapeutic windows in solid tumors previously considered off-limits due to toxicity.

Whether Avacta becomes the platform leader in this emerging space will depend not just on preclinical theory, but on clinical proof, capital discipline, and strategic execution. Still, with a clear mechanistic rationale and growing attention on tumor stroma biology, PDCs may be carving out the next frontier in cancer therapeutics—one that even the ADC giants may not see coming.

Discover more from Business-News-Today.com

Subscribe to get the latest posts sent to your email.